On Sustainability: No Two Consumers Are Alike

Savvy marketers rely on the principles of customer segmentation and product targeting to more efficiently allocate scarce resources and effectively reach groups of consumers with similar preferences or demands. It would appear as though many people have jumped on the eco-train, but to what extent have people who purchased plants, many of them gardeners, adopted eco-practices like recycling and composting? Previous research shows some consumers are willing to pay a premium price for green products and share attitudes that are favorable toward the environment.

Premium-priced products are assumed to be more profitable, and often are. Still, relatively little is known about gardeners and their ecological attitudes, practices or behaviors. Our objective was to identify and profile consumer segments with regard to their gardening purchases. Are gardeners more eco-friendly? We sought to determine whether there were differences in their eco-friendly attitudes and behaviors, such as recycling. Our underlying belief was that some types of gardeners may be more active in their environmentally-friendly behavior, predisposing them to be more receptive to product innovations specifically designed to be eco-friendly.

Consumer Demographics

Our research team developed an online survey and collected data in July 2009 using Knowledge Network’s Web-enabled KnowledgePanel. This is a probability-based consumer panel designed to be representative of the U.S. population. The survey was administered through the Internet accessing a sample of 300 KnowledgePanel consumers from Indiana, Michigan, Minnesota and Texas. Questions on the survey focused on the types of ornamental plant purchases made by consumers, recycling behaviors, preferences for various types of plant container materials and demographic characteristics.

Responses were collected from 1,113 consumers, but only 763 were complete and useful. Nearly one quarter of the participants were from each state participating in the study: Indiana (24.4 percent), Michigan (27.2 percent), Minnesota (24.7 percent) and Texas (23.7 percent). Participants ranged in age from 18 to 92 years with an average age of 47.2 years old. More than half (52.3 percent) were married, 22.7 percent were never married and 11.5 percent were divorced. More than one-third (36.5 percent) of participants had completed only high school and an additional 24.1 percent had completed some college; an additional 15 percent had completed college and 7.6 percent had completed education beyond a bachelor’s degree. Nearly 80 percent of the participants were Caucasian, 8.5 percent were African-American, 7.8 percent were Hispanic and 4.5 percent were two or more races or from another ethnic background.

Slightly more than 80 percent lived within the Metropolitan Statistical Area (MSA) classification, which is considered urban and suburban, and 19.4 percent were from outside those regions, which could be considered rural. About 80 percent owned their home and 79.7 percent lived in a one-family detached residence. Participant household income was distributed among the 19 categories (with $2,500 to $10,000 increments), with the median in the $60,000 to $74,999 category (12.4 percent). No category had less than 1.7 percent of the participants included in it. Slightly more than 70 percent of the participants had Internet access. So, study participants generally exhibited characteristics reflective of the United States on average.

Results

Within the entire sample, 54.8 percent of the participants purchased annuals, 45.3 percent purchased perennials, 43.5 percent had purchased vegetables or herbs, 19.2 percent had purchased flowering shrubs, 12.3 percent had purchased trees and 24.5 percent had purchased indoor flowering plants. These were similar to a 2006 National Gardening Association survey that showed 33 percent of Americans participated in flower gardening, 30 percent participated in landscaping and 22 percent participated in vegetable gardening.

Of those buying flowering annuals, 10.9 percent were first-time buyers of annual plants. For perennials, 4.7 percent were first-time buyers. Among herb and vegetable purchasers, 5.1 percent were first-time buyers, but only 2.8 percent of flowering shrub buyers were first-time purchasers of those plants and 3.6 percent of tree purchasers were first-time buyers. Among indoor flowering plant purchasers, 2.7 percent were first-time purchasers.

Given the recent anecdotal evidence that sales of edibles have increased, we were curious whether a substantial percentage of new or first-time purchasers might be identified, but this was not the case. There were more first-time annual plant purchasers than herb or vegetable buyers.

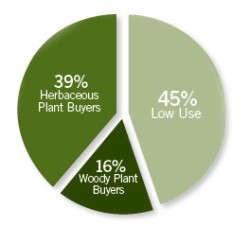

We then clustered participants into three groups (Figure 1, page 42) based on their purchase history of five outdoor plant categories: flowering annuals, perennials, herbs and vegetables, flowering shrubs and trees. The first consumer segment to emerge was named “Low Use.” This group was characterized by a low percentage (more than 25 percent) of its members (n=341) buying perennials, herbs or vegetables, flowering shrubs and trees. No members of this group purchased flowering annual plants.

The second segment to emerge (n=127) was labeled “Woody Plant Buyers” because a high percentage of this group had bought flowering shrubs and trees (evergreen or deciduous). This segment had a moderate percentage of individuals who had purchased flowering annual plants, perennial plants, herbs or vegetables and indoor flowering plants.

The third segment to emerge was labeled “Herbaceous Plant Buyers” because a high percentage of this group (n=295) had bought flowering annual plants, perennial plants, indoor flowering plants and herbs or vegetables. None of the Herbaceous Plant Buyers had purchased any flowering shrubs.

We saw some differences in the number of shopping trips made and the dollar amount members of these groups spent on plants and gardening in the year before the survey. A greater percentage of Low Use members (34.9 percent) and Herbaceous Plant members (38.0 percent) spent $1 to $100 on gardening products compared to Woody Plant members (10.4 percent), but a higher percentage of Woody Plant members (6.9 percent) and Herbaceous Plant members (6.8 percent) spent more than $100 on gardening products compared to Low Use members (3.0 percent). Woody Plant members made the most number of trips to a store, which resulted in a plant purchase (7.4) compared to Herbaceous Plant members (4.6) and Low Use members (3.0).

Analysis

Demographically, the groups differed on most characteristics. Both Woody Plant Buyers and Herbaceous Plant Buyers had a higher percentage of women than men, which was not the case for the Low Use consumers who were predominantly male. Average age of Woody Plant Buyers was higher than Herbaceous Plant Buyers and both were higher than the mean age of consumers in the Low Use segment. Herbaceous Plant Buyers had achieved a higher level of education than Low Use or Woody Plant cluster members.

Also consistent with a 2009 study Jennifer Dennis and Bridget Behe conducted was the high percentage of Caucasians, married individuals and homeowners in the Herbaceous Plant and Woody Plant buyer segments relative to the Low Use segment. There were no differences among the segment members with regard to the metropolitan statistical area (MSA) status or access to the Internet.

While attitudes were relatively similar, some eco-behaviors did vary between the segments (Figure 2). Researchers asked two questions about the purchase and disposal of beverage containers: water bottles and aluminum cans. We were interested to learn whether the percentage of each segment that purchased and recycled these beverage containers or simply did not purchase them was similar; either could be construed as an eco-friendly decision. Our thought was that if the product was purchased and waste handled in an eco-friendly manner, the segment members may be more responsive to eco-marketing, packaging or other messages consistent with their eco-behaviors.

Only one state (Michigan) had a mandatory recycling of aluminum cans, for which a deposit is paid on the can when it is purchased. More of the Low Use segment did not purchase aluminum drinking cans or bottled water compared to Herbaceous Plant and Woody Plant consumers. Fewer Woody Plant buyers always recycled aluminum drinking cans compared to Herbaceous Plant and Low Use buyers. But we found no differences in the purchase and recycling of bottled water bottles.

There were differences between the three groups with regard to the purchase and recycling of newspapers and magazines. More Low Use consumers did not purchase newspapers and magazines compared to Woody Plant and Herbaceous Plant buyers, but more Low Use consumers also never recycled them. However, a higher percentage of Herbaceous Plant buyers always recycled both newspapers and magazines compared to the other two groups.

Composting is a form of recycling and researchers asked study participants about their recycling of food and yard waste. A low percentage of the three groups always composted food waste, but a higher percentage of Low Use and Herbaceous Plant consumers never composted food waste. We expected a higher percentage of the Low Use consumer group would have no yard waste, but we were surprised to see the similarly high percentage of Low Use and Herbaceous Plant consumers to never compost yard waste.

We asked participants several questions to assess their attitudes about recycling and buying products made from recycled products. Of the six questions asked, only one difference emerged. A lower percentage of Woody Plant buyers agreed or strongly agreed (10.5 percent) with the statement “Sorting household waste for recycling is too much of an inconvenience” compared to Low Use (23.8 percent) and Herbaceous Plant buyers (25.0 percent). There were no differences in the percentage of consumers that agreed or strongly agreed with these five statements: 1) When purchasing products, I check to see whether the package is made from recycled material; 2) A carbon intensive footprint for a product means it takes a lot of energy to manufacture or ship the product; 3) I refuse to buy products from companies that are not environmentally friendly; 4) Recycling plastic plant pots is of more importance than using compostable containers; and 5) When buying products, I check to see whether the package is recyclable.

Despite similar attitudes and having been exposed to the concept of sustainability, the two plant purchase segments appeared to engage in more eco-friendly behaviors more than the Low Use segment. In a 2010 article, we showed that the consumers had different preferences for plant containers, finding that the single-most important factor influencing the consumer buying decision was container type, followed by price, carbon footprint and waste composition, respectively.

Coupled with the results from this study, green industry participants now have a better understanding of the diversity of consumers to which they market products. Eco-behaviors may be a more effective means of reaching or connecting with consumers who have a greater propensity to purchase eco-friendly products or those made using eco-friendly practices.