Nursery News & Blues

We’ve been hearing how nursery growers focused on woody ornamentals are faring much worse than greenhouse growers producing spring annuals. The headlines we published last fall indicate there will be a pretty big shakeout in the nursery landscape next year, even plant shortages.

Hines Nurseries is back in Chapter 11 for the second time in two years. Carolina Nurseries has closed its doors. Monrovia is asking for a $20 million bailout from its faithful indpendent garden center customers, while seriously considering serving the box stores for the first time in 15 years.

Hines and Monrovia have iconic histories. Both were founded in the same region of California in the 1920s but pursued different paths. Monrovia built a brand based on quality and selection and focused on the independent garden center channel to uphold the value of its brand. Hines gravitated more to the box stores while still serving independents.

Hines has had a revolving door of outside investor ownership and was publicly traded. Last year it focused on getting back to being the company it used to be and brought many of its leaders from 10 years ago back. But can you really go back to the future when so much in the market has changed?

For instance, The Berry Family of Nurseries in Oklahoma has emerged as the force to be reckoned with serving box stores. In 16 years, the company grew from one farm to 13 through acquisitions, which were all financed by the family business. While Hines, Monrovia and Carolina have been struggling to secure financial footing, The Berry Family just took on a private equity investor who infused $50 million in working cash into the business.

For many in this industry, outside investors and ownership have been the kiss of death. It only seems to work when the principals who built the business stay involved.

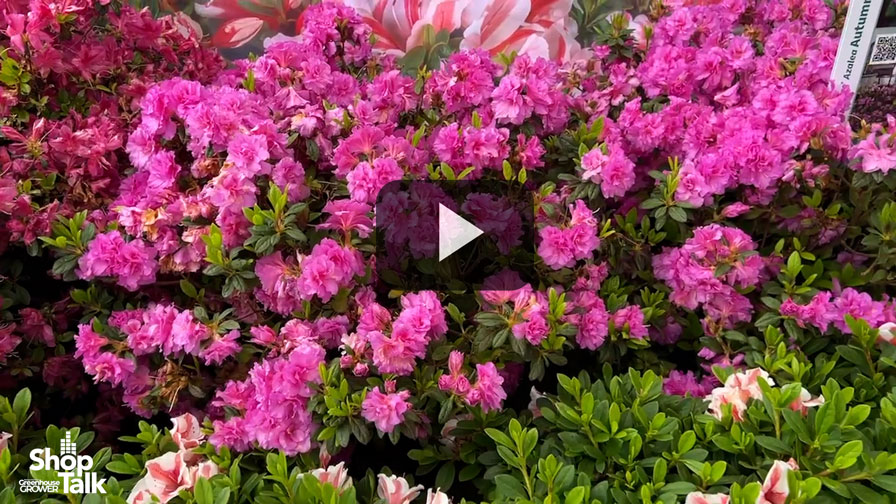

I spent a half hour on the phone talking to father-and-son team Bob and Burl Berry and was really impressed with their sense of purpose and direction. They launched with a clear vision to serve large retailers, even though independent garden centers still represent a good chunk of their business, $20 million. They have been able to serve both markets and produce leading brands including Knock Out and Flower Carpet roses, Encore azaleas and Forever & Ever hydrangeas.

Being less than 20 years old, the company was never rooted in the wholesale landscape trade and wasn’t as affected by the halt in housing and construction. More traditional nurseries have been saddled with too much inventory that took up space and became too old or past its prime. They haven’t had the cash or space to replant fresh inventory, which is why many are expecting shortages in plants this year.

Regional nurseries are facing the same issues, and changing with the times has been painful. One operation that has been really proactive in taking charge of its destiny is Willoway Nurseries in Ohio.

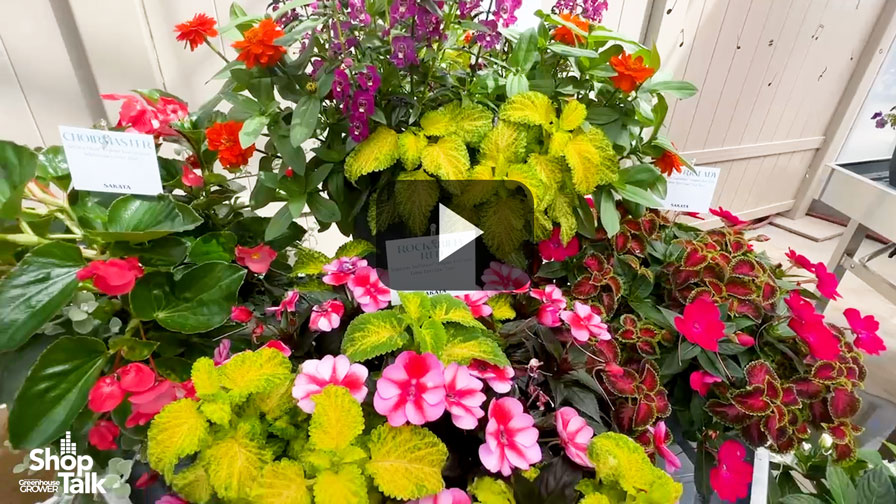

The company has invested in modern facilities that expand the possibilities of what can be grown. Willoway is always refining its crop mix and has expanded beyond perennials, trees and shrubs, to also offer annuals, tropicals and combination planters. Simple videos on YouTube show what’s available now.

Willoway has changed its customer base from 60 percent landscapers/40 percent garden centers to 80 percent garden centers/20 percent landscapers. The company also has expanded its geographic reach by adding sales representatives and regions, while helping garden centers with merchandising to increase sales.

Willoway also has fully embraced lean manufacturing principles to drive labor costs down. “We can’t control the cost of perlite or things dictated to us. Labor is where we’re trying to hit it hard,” says Willoway’s Cathy Kowalczyk. “We’re trying to work smarter.”