Top 25 Young Plant Growers

Certain plug and liner sizes are becoming more attractive, new crop categories are showing potential and the window for demand is narrowing for some growers on our Top 25 Young Plant Growers list. Most growers experience at least minor changes from year to year, but 2009 turned into a year of big change for some of the top plug and liner growers.

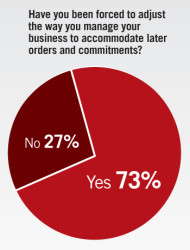

A few growers report growing larger plugs than years past, even more say the demand for vegetables is up and the majority of Top 25 Young Plant Growers we surveyed indicate they’re being forced to make adjustments to accommodate later orders and commitments.

Looking At The List

One thing has changed little, though: the operations that appear on our Top 25 Young Plant Growers list. Only one operation, Twyford International, drops off this year’s list, as Zylstra Greenhouses in Kalamazoo, Mich., takes the 25th and final spot on it.

The bar has been raised this year to appear on our Top 25 list, as well. Last year, Twyford rounded out the Top 25 with 22-25 million young plants produced to sell. Zylstra rounds out the list this year with 30 million.

Most of the growers at the very top of the list are, however, producing less plugs and liners this year. Tagawa Greenhouses and Ball Tagawa Growers, which remains at No. 1, is producing 30 million less young plants this year and 40 million less than it was two years ago.

“The biggest chunk of reduction we had was consolidation of Walmart suppliers,” says John Miller, Tagawa’s sales and marketing director. “Walmart went through another round reducing the growers at Walmart stores. We had quite a few plug customers who were Walmart growers in 2008 that were not in 2009.”

| Top 25 Young Plant Growers | ||||||

|---|---|---|---|---|---|---|

| 2009 Rank | Young Plant Grower | 2008 Rank | 2009 Quantity | State | Years In Young Plants | |

| 1 | Tagawa Greenhouses and Ball Tagawa Growers | 1 | 460 million | CO | 42 | |

| 2 | Green Circle Growers | 2 | 450 million | OH | 41 | |

| 3 | Van de Wetering Greenhouses | 12 | 280 million | NY | 20 | |

| 4 | Speedling | 3 | 275-280 million | FL | 41 | |

| 5 | C. Raker & Sons | 5t | 200 million | MI | 31 | |

| 6 | Plug Connection | 5t | 185-190 million | CA | 22 | |

| 7 | ForemostCo Inc. | 4 | 180 million | FL | 22 | |

| 8t | Knox Nursery | 7t | 150 million* | FL | 46 | |

| 8t | Wagner Greenhouses | 7t | 150 million | MN | N/A | |

| 10 | Bob’s Market & Greenhouses | 9 | 128-130 million | MV | 13 | |

| 11 | Kube-Pak Corp. | 10t | 120 million | NJ | 37 | |

| 12 | Floral Plant Growers | 16 | 115 million | WI | 33 | |

| 13 | Jolly Farmer Products | 10t | 111 million | NB | 26 | |

| 14 | Plainview Growers | 13 | 110 million | NJ | 19 | |

| 15 | Aris Horticultural Services | 14 | 80 million | OH | 89 | |

| 16 | Cal Seedling Co. | 15 | 60-65 million | CA | 16 | |

| 17 | EuroAmerican Propagators | 18 | 53 million* | CA | 16 | |

| 18 | Van Wingerden Greenhouses | 19 | 50 million* | WA | 29 | |

| 19 | Four Star Greenhouse | 21 | 48 million* | MI | N/A | |

| 20 | First Step Greenhouses | 17 | 46 million | CA | 12 | |

| 21 | Wenke/Sunbelt Greenhouses | 22 | 43.6 million* | MI | 28 | |

| 22 | Mast Young Plants | 24 | 35-40 million | MI | 16 | |

| 23 | Northwest Horticulture | 20 | 36 million | WA | 9 | |

| 24 | Pleasant View Gardens | 23 | 35 million | NH | 33 | |

| 25 | Zylstra Greenhouses | NR | 30 million | MI | 12 | |

Growing Less

The majority of the Top 25 are producing less much like Tagawa is. Eleven of the Top 25 are producing less young plants than they were a year ago. In fact, only four report increasing their production, and the rest are producing about the same number as 2008.

The biggest riser on this year’s list is Van de Wetering Greenhouses in Jamesport, N.Y., which moves up nine spots and now only sits behind Tagawa and Green Circle Growers. Van de Wetering has underreported its production the last few years, and its report this year shows the operation is growing 160 million more plugs than we previously thought. Maintaining all those young plants is a major challenge, though.

“Our biggest challenge is maintaining product that can’t be shipped due to the customer’s inability to take orders,” says Walter Gravagna, Van de Wetering’s vice president.

Managing inventory is a challenge for Jolly Farmer Products in New Brunswick, too. Sales manager Peter Darrow says the operation solves those issues primarily with lean-flow principles.

“We hired Flow Vision, and their work has proved to be invaluable to our business,” Darrow says. “We are also focusing on inventory management through working more closely with our customers to secure orders by time of production rather than speculation.”

Get It Done!

Still, securing just-in-time orders is no easy task. Just ask Henry Huntington, co-owner of Pleasant View Gardens in Loudon, N.H.

“Our demand window has really narrowed and it really strains our labor and space capacity,” Huntington says. “Contract growing and creating more lean processes has helped solve these issues.”

Pleasant View isn’t the only operation being forced to adjust the way it manages its business to accommodate later orders and commitments. Seven of the 11 Top 25 Young Plant Growers we surveyed say they are being forced to make an adjustment.

Bob’s Market and Greenhouse has to analyze its available space before just about any late order. Northwest Horticulture plans based on its best customers’ previous orders, and Zylstra Greenhouses monitors spec number closely during peak ship weeks.

Owner Dan Gibson of First Step Greenhouses, however, says his operation has always tried to squeeze in last-minute orders for its customers. It’s simply part of business, he says.

Plug & Liner Sizes

So what’s happening with the size of plugs and liners? Many of the growers we surveyed say their customers are asking for different sizes than past years.

Van de Wetering’s Gravagna says the trend right now is bigger plugs for quicker turns. Bobby Barnitz of Bob’s and Mike Owens of Cal Seedling Co. both agree, saying 288-cell plug trays are increasing in sales. Barnitz specifically says 288s represent two-thirds of Bob’s young plant business right now, whereas 512-cell trays represent about one-third.

As far as liners go, Pleasant View’s Huntington says growers are asking for liners that match up with different containers they’re using.

“We are offering multiple sizes of the same plant variety right now, where only a few years ago it was one size,” Huntington says. “Growers are looking for product they can finish faster to achieve more turns.”