How Plug & Liner Operations Are Overcoming The Decline

The greenhouse operations that make up our latest Top 25 Young Plant Growers list are the same 25 as one year ago. But there’s a glaring difference between this year’s Top 25 and last year’s: the number of young plant units those growers produced to sell this year compared to 2010.

Last year, the growers on our Top 25 list produced more than 3.5 billion young plants to sell. This year, the Top 25 as a whole is producing 10 percent fewer young plants to sell. Nine of the 25 indicate their young plant sales are down while only four say they produced more to sell this year than in 2010. Production for the other 12 growers on the list is flat (Table 2).

Among the operations reporting increased young plant sales are Floral Plant Growers, whose 20 to 21 million increase is the most significant positive change among the Top 25. Plug Connection (up as many as 5 million), Battlefield Farms (up 3 million) and Cal Seedling (up 2 million) also report slight production increases.

On the flip side, Green Circle Growers reports its young plant business is down considerably from a year ago. In 2010, Green Circle ranked second on our Top 25 list behind Tagawa Greenhouses and Ball Tagawa Growers with 380 million units produced to sell. This year, however, Green Circle produced 32 percent fewer units to sell–down 120 million young plants.

Green Circle isn’t the only operation down in young plants, though. Production is down at a number of operations and for a variety of reasons, including an economy that’s shrinking the Top 25’s customer base and rising competition like Total Growth Solutions that’s taking existing business away. There’s also the possibility a number of former customers are now handling their own propagation.

“Customers continue to demand larger sizes to offset rising heating and chemical costs,” says Green Circle’s David Van Wingerden. “At retail, larger combo containers continue to dominate, driving pack numbers down.”

Tagawa still tops our top 25 list with 450 million young plants produced, but its units are down 10 percent over last year’s. Speedling reports its units are down between 10 and 20 percent; C. Raker & Sons indicates it’s down 10 percent; and ForemostCo’s units produced are down about 33 percent.

“Our biggest problem is a market that is not growing and a commodity product,” says Paul Karlovich, Raker’s general manager. “We are solving the problem through efficiency improvements and new initiatives that leverage our growing expertise.”

The improvements or strategies Karlovich is trying include pre-buying natural gas, using energy-savings devices and consolidating product in the facility whenever possible.

Pricing is another challenge young plant growers are facing. Tom Van Vugt says the biggest challenge he faces as vice president of sales at Plainview Growers is balancing higher input costs with lower plug pricing. One energy-savings step Plainview has taken in recent years is the installation of a biomass boiler to burn wood and grass pellets. Green Circle and Pleasant View Gardens have also installed biomass systems within the last couple years.

“We are streamlining our processes and making ourselves more efficient to cut costs,” Van Vugt says.

Another New Jersey grower, Kube-Pak’s Bill Swanekamp, says pricing is the biggest challenge his operation faces, too.

“We need to raise our prices to cover the true costs of production–even if it is not popular,” he says.

Seeds vs. Cuttings

As part of our annual young plant grower survey to produce this report, we asked growers to break down their young plants produced from seeds, cuttings, tissue culture and bare root/divisions. In addition to surveying the Top 25 Young Plant Growers, we compiled data from young plant growers not ranked on the Top 25 list.

Of all the young plants the Top 25 is producing, we learned 77 percent are grown from seeds, 22 percent are from cuttings and less than 1 percent are from tissue culture. When we took a step back and looked at the young plant grower community as a whole (also including the top 25), we found more material is still being produced from seeds (47 percent) than cuttings (43 percent) but the gap between the two is significantly smaller (Table 2).

We also asked young plant growers about transitioning from seeds to cuttings, and vice versa, on certain crops. Swanekamp, for example, says Kube-Pak has moved from cuttings to seed-based angelonias. Lisa Ambrosio, meanwhile, indicates Wenke/Sunbelt Greenhouses is moving in the opposite direction with angelonias.

“We use cutting angelonia more than seed because they are larger, so it’s easier to get to size in Michigan,” she says. “But I think more items are going from cuttings to seed.”

Among the cutting-to-seed items Wenke/Sunbelt has adopted are Gryphon begonias, Plentifall pansies and Toucan portulacas. Ambrosio has also noticed new trends in liner sizes.

“Fifty-cell combo liners are growing in demand,” she says. “We’re also doing more with smaller liners in 209 trays.”

Other liner and plug size trends among the Top 25 growers include:

– More sales in plug sizes from 288 on up and less demand for 512s, according to Kube-Pak’s Swanekamp;

– Growers moving to higher density liners, such as from 84s to 128s like Pleasant View; and, of course

– Growers demanding larger plugs at smaller plug pricing, according to Van Vugt.

Order Fulfillment & Delivery

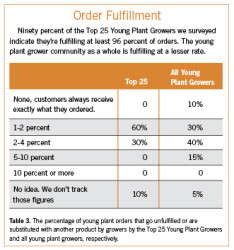

Another area we asked the Top 25 Young Plant Growers about is order fulfillment (Table 3). Not a single operation among the Top 25 indicates it’s fulfilling every single order as requested, but the majority (60 percent) indicates all but 1 to 2 percent of orders are fulfilled as requested (including no substituted material). Thirty percent of the Top 25 say they fulfill between 96 and 98 percent of all orders, and only one of the Top 25 we surveyed indicated it wasn’t aware of its fulfillment rate because it does not track such data.

Again, taking a step back to look at the entire young plant grower community, the order fulfillment rate among all growers is not as strong. An astounding 10 percent of the growers we surveyed say every last order they take is fulfilled. Seventy percent of the entire young plant grower community meets at least 96 percent of all orders. Only 15 percent of young plant growers say they do not reach that 96-percent mark.

To Randy Tagawa, CEO at Tagawa Greenhouses, order fulfillment has been a major challenge but it’s an area on which his operation has recently homed in.

“We’ve been working to make sure we give our customers 100 percent order fulfillment and A-plus quality 100 percent of the time,” Tagawa says. “Our order fill rate has increased to 99.27 percent.”