How To Know If You Have Too Much Inventory

Steve Bailey

As owners and managers began the wind-down to the hot summer season when customer count dwindles, many were thinking the same thing as they gazed at the sales yard: Why do we still have so much inventory?

This is a common — and correct — reaction. But before you determine your garden center has too much inventory, let’s first take a look at the possible causes. Several things, big and small, assisted in this gradual buildup.

High Sales Masks High Inventory

The 1990s and early 2000s were an era of increasing revenues. It was easy for garden retailers to, as the popular phrase goes, set ’em down and let the customers pick ’em up. And pick them up they did, with increasing annual customer counts and increased revenue each year.

It wasn’t difficult for Owners/Managers/Buyers to argue that the sales yard and building had to be full all the time or the customer would go elsewhere.

This was an easy route to take due to one of our most reliable retail ratios (margin percentage) lying, telling us our margins were increasing during this period, while the truth was that the higher ending inventory was falsely inflating the attained margin in the Cost of Goods Sold formula. So margins were good, while the customers were not picking up as many as centers sat down. Inventory accumulated.

Garden centers floated along for years, relying on margin data to show they were holding their own in margin, while profit remained stable or slightly declined.

Profit decline was not enough to throw up red flags, although it should have, and so little was done to combat increasing/aging inventory.

Then came 2008. The lack of a solid buying budget or plan was evident as the dark cloud on the horizon did little to curb excess buying. While the majority of lawn and garden retailers began cutting inventory, garden centers continued to buy as if the boom was still on. Or if they did cut back, they cut back in areas that were actually prospering and overbought in favorite areas that were sacred cows to their center.

As the economic crunch deepened, the inventory situation worsened. Now it was easy to see the effect of excess inventory. Revenues continued to decline, while operating and Wage & Wage Beneifts expenses — AKA, the carrying cost of inventory — increased in order to care for the same or more inventory. This imbalance showed up on the profit line and began a slide in equity on the balance sheet. Less profit usually translates into less wealth.

How To Know If You Have Too Much

Let’s examine a few methods that will give you a glimpse into your inventory situation.

1. Simply look around. The first step is pretty easy — just look around and use the seat-of-the-pants approach described at the beginning of this article. If the warehouse and sales yard are full of inventory, sales are declining, customer count is dwindling, labor costs for maintaining the inventory are high and you are faced with holding that inventory for another six months to a year before selling it, you’ve got a problem.

Even if you think you don’t have an over-inventoried issue, move on to the next steps and know for sure.

2. Do a simple check of past inventory levels. Begin by charting your annual beginning and ending inventory at cost for the past 10 years. It’s easy to do if your accounting systems are set up properly.

3. Apply an easy formula. In order to determine if inventory values affected your attained margin, subtract beginning inventory from ending inventory and divide that number by revenue:

(Ending Inventory – Beginning Inventory) ÷ Revenue.

A positive number shows how much your inventory overstates your attained margin. An increase in ending inventory is justified only if the amount of increase is in scale to revenues rising. And, of course, if your inventory is already under control.

If the number is negative, that’s the decrease in attained margin due to a lower ending inventory. And when you think about that, it makes sense due to the nature of lowering inventory — sale events, drastic reductions or just plain throwing away inventory. Reducing ending inventory is usually a good sign if you are over-inventoried, but it will only occur for the first two to three years after inventory control is initiated.

4. Create a stock-to-sales ratio. The next step is the most eye-opening. This method involves calculating and charting the stock-to-sales ratio, a ratio you probably have not heard of. So before you begin that process you will need to know how to calculate it and what the resulting value means.

The stock-to-sales ratio is the relationship between the amount of inventory on hand vs. the amount of inventory sold — both at cost. In other words, how much you sold while you had goods in stock.

Retail wisdom says a retailer should have an annual ratio of 2.5 or lower. Note I said annual, since the ebb and flow of revenue and inventory will move that ratio around significantly on a monthly basis. For example, monthly values for an annual 2.5 stock-to-sales ratio might range from 0.7 to 9.0. Also note that the ratio usually does not dip below a 1 to 1 ratio, unless the inventory moves in and out very fast.

Examine Inventory By Product Category, Not Department

My recommendation is to calculate the annual stock-to-sales ratio on a category basis. A total store stock-to-sales ratio lacks the detail needed if you identify a problem, and most of you will have one.

Even a department value lacks the detail of a category measurement. A category stock-to-sales ratio will be a huge determining indicator of a problem, but will also tell you where to concentrate your efforts for improvement — or elimination.

To calculate the category stock-to-sales ratio, construct a spreadsheet in which you input 12 month’s values for both inventory sold at cost and the amount of inventory on hand at cost.

The date range can be a calendar year or any 12-month period. I prefer to use the last 12 months that includes the busy spring season and allows for planning the next 12 months.

Sum both rows or columns and divide that value for the amount of inventory on hand by the amount of inventory sold. The formula will look like: (12 Months Of Inventory On Hand At Cost) ÷ (12 Months Of Inventory Sold At Cost). The resulting value is the stock-to-sales ratio.

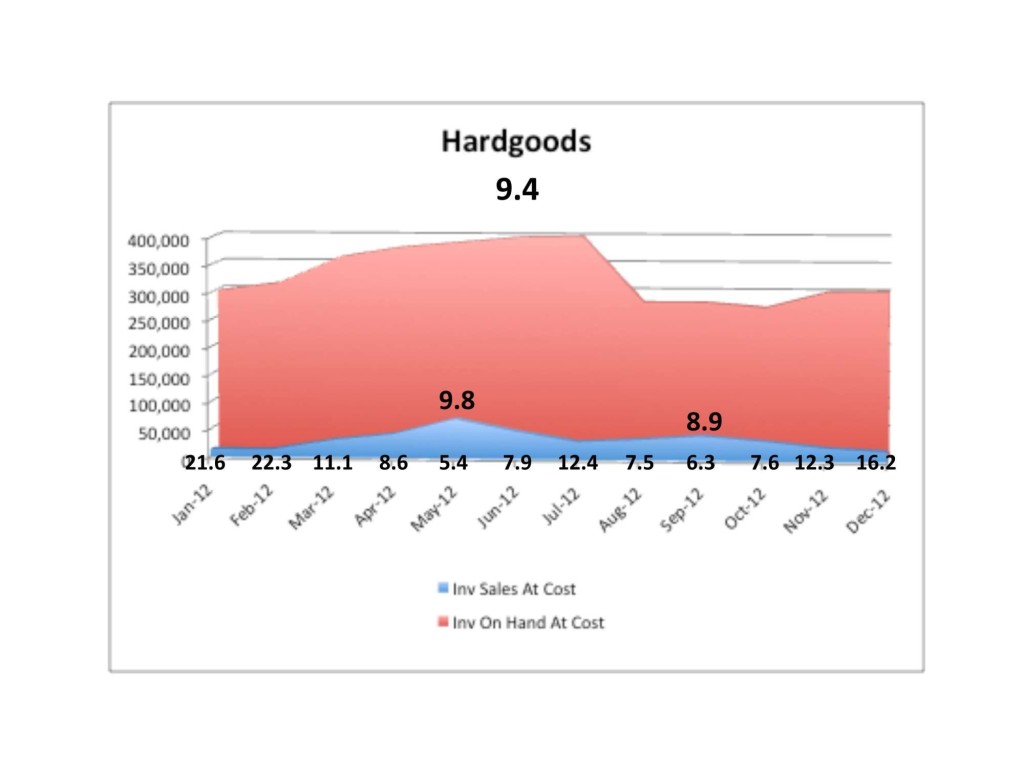

The 2.5 ratio is a beginning point for determining good or not-so-good performance. Take this one step further and construct a chart in your spreadsheet graphically showing the relationship between the numbers. If your stock-to-sales ratio is high, the chart will look something like this:

Here, the annual stock-to-sales ratio is 9.4. At a glance, you see a large amount of inventory is on hand even when revenues are not being generated (and there’s no need for inventory).

As I said, this is a great tool to use with owners and staff as it graphically shows the inequity of revenue to inventory. Although the category here is hardgoods, it could be plants or goods of any type.

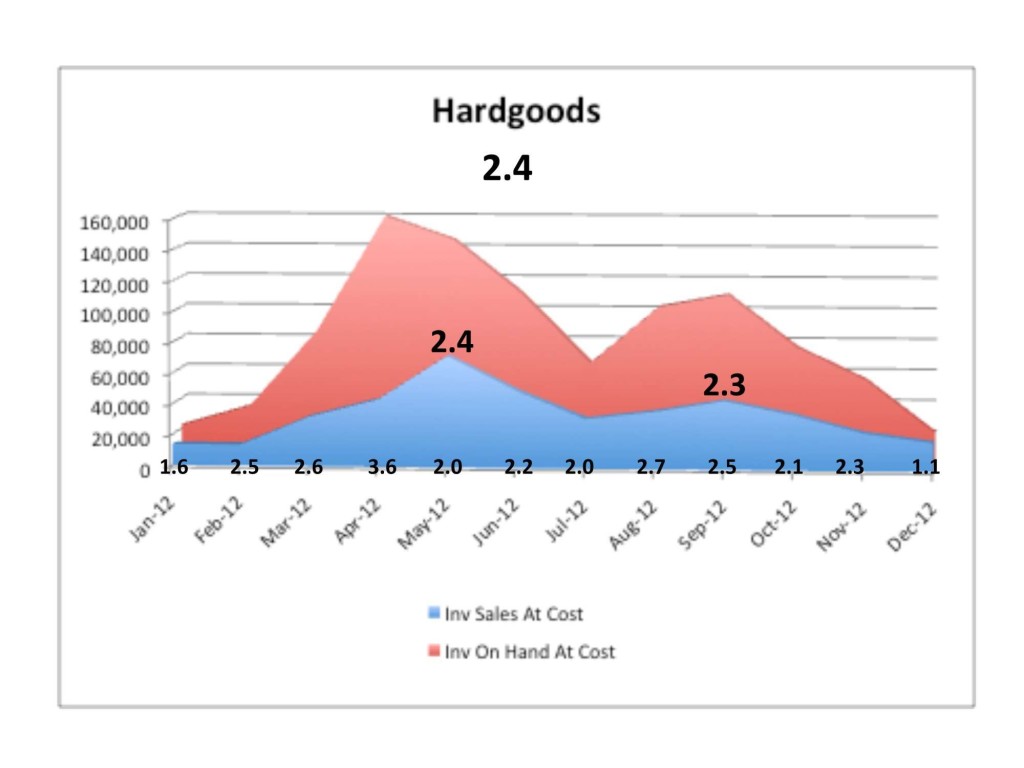

Compare that chart to the same category that has been managed much more efficiently. The inflow and outflow of inventory matches the revenue curve by season. Of particular note is the amount of inventory on hand, $160,000 maximum compared to $400,000 in the previous example — with the same revenue.

In this case, the stock-to-sales ratio is 2.4, with inventory peaking at or slightly before the revenue peak, declining in-between seasons and minimal at the end of the year measured. Also, at no time is the garden center totally out of inventory since new inventory is arriving for the next season, while the inventory from the current season is declining.

As good as your stock-to-sales ratio is, it can be better. Begin with tying in inventory turns and margins to measure and improve total inventory performance. We’ll bring in those steps in the next two issues. Now, get out there and start plotting what you would do if all of the value of your inventory on hand were in the bank instead of being moved, dusted and watered!