Cuttings Producers Improve Quality and Focus on Streamlining the Supply Chain

It’s been two years since Greenhouse Grower last produced its Top Cuttings Producers ranking. We thought it would be prudent to provide this information biennially, because little seems to change in the rankings of producers from year to year. But although the list is mostly the same, much has changed in the way of innovation, commitment to sustainable production, improved sanitation protocol, and quality. Cuttings producers worldwide are constantly watchful of the changing demands of the marketplace and — because much of the supply chain starts with them — how they can implement new practices and offerings to streamline availability to growers and ultimately help make consumers more successful.

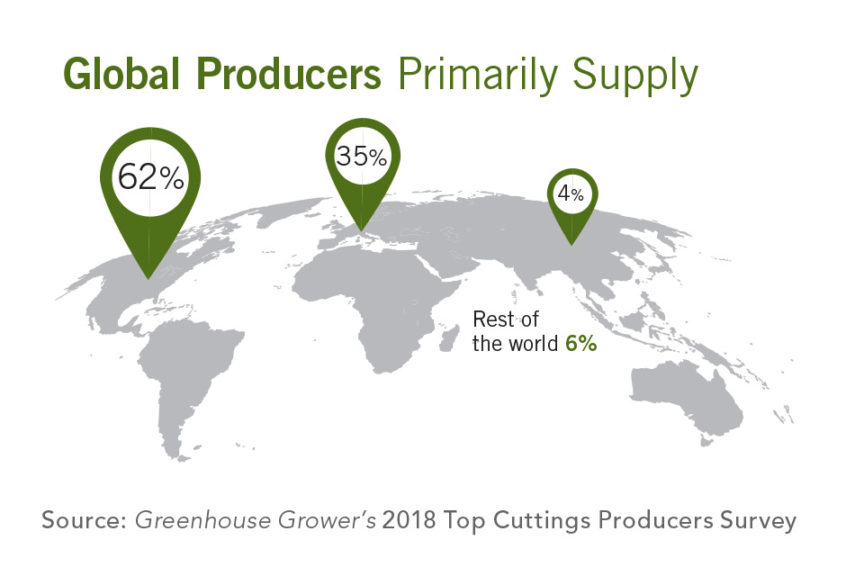

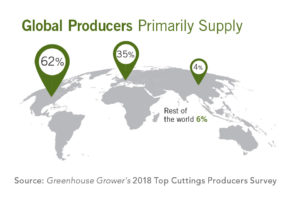

According to the breeders and independent producers who answered Greenhouse Grower’s 2018 Cuttings Survey, most of whom make up the majority of the world’s vegetative cuttings production, 62% of the cuttings they produce are shipped to North America. The demand for unrooted cuttings continues to increase, said Dominik Neisser of Vivero Internacional.

“The cutting supply is growing on demand,” he said. “More companies are switching from purchasing liners to self-propagation. Improved technologies like LED lighting and others are helping companies to be more successful.”

| 2018 Rank | Company | Cuttings Produced (% for North America) | Production Space Dedicated To Cuttings | Crops | Production Facilities | 2016 Rank |

|---|---|---|---|---|---|---|

| 1 | Beekenkamp | 1.5 billion (2%) | 222 acres | Annuals, Perennials, Cut Flowers, Flowering Potted Plants, Foliage, Tropicals | Ethiopia, Uganda | 2 |

| 2 | Dümmen Orange | 1.4 billion (24%) | 375 acres | Annuals, Perennials, Cut Flowers, Flowering Potted Plants, Herbs, Succulents, Foliage, Tropicals | Guatemala (2), El Salvador, The Netherlands, Ethiopia, Germany, Italy, Kenya, Spain, Tanzania, Uganda, U.S. | 1 |

| 3 | Danziger “Dan” Flower Farm | 510 million | 63 acres | Annuals, Perennials, Cut Flowers, Flowering Potted Plants | Israel, Kenya, Guatemala, Ecuador, Colombia | 3 |

| 4 | Selecta Klemm | 500 million (20%) | 140 acres | Annuals, Perennials, Cut Flowers, Flowering Potted Plants, Herbs, Woody Ornamentals | Israel, Kenya, Spain, Uganda | 4 |

| 5 | Florensis | 320 to 330 million (2%) | 111 acres | Annuals, Perennials, Flowering Potted Plants, Foliage, Herbs | Ethiopia, Kenya, Portugal, Spain | 7 |

| 6 | Syngenta Flowers | 250 million (100%) | 80 acres | Annuals, Perennials, Flowering Potted Plants | Ethiopia, Guatemala, Kenya, Mexico, U.S. | 5 |

| 7 | Cohen Propagation Nurseries | 220 million (20%) | 38 acres | Annuals | Israel | 6 |

| 8t | Ball FloraPlant | 165 million (80%) | 115 acres | Annuals | Guatemala, Nicaragua, Mexico, Portugal, Ethiopia, Kenya | 8 |

| 8t | Kientzler/Innovaplant de Costa Rica | 165 million (78%) | 32 acres | Annuals, Herbs, Perennials, Woody Ornamentals | Costa Rica, Germany | 9 |

| 10 | Vivero Internacional | 120 million (95%) | 100 acres | Annuals, Flowering Potted Plants | Mexico | 10 |

Reducing Labor for Growers

Many of the unrooted cuttings producers said they’re excited about the cutting sticking technology that has come into the marketplace, and helping growers reduce labor. Because labor is a concern for young plant growers and finished growers alike, finding labor-saving processes and programs has been at the core of many producers’ activities, they say.

Yet cuttings suppliers also face a learning curve in producing cuttings that new cutting sticking machines can detect, which can require more labor and worker training. Meanwhile, labor shortages aren’t limited to growers — there’s a worldwide labor shortage that causes issues for cuttings producers and other suppliers as the industry heads into a new production season. Increased labor costs translate to higher costs, which ultimately affects growers.

Unpredictable freight costs are also causing uncertainty of order fulfillment for the supply chain from cuttings farms all the way to the end consumer, and political unrest in some countries of production could also affect the ability for order fill.

Sanitation Measures, Reducing Chemicals, and Adopting IPM

Over the past three years, all offshore cuttings producers have been busy implementing phytosanitary requirements to ensure the consistent supply of clean cuttings to the market. Producers are investing in clean production with continued employee training on sanitation and updates in equipment including benches, water lines and treatment systems, thrips screens, coverings, foot baths and disinfection areas. Through participation in the USDA pilot program (see page 36) and building new state-of-the-art elite facilities to meet international and corporate guidelines, as well as imposing strict virus prevention protocol that includes more virus testing across more plants, cuttings producers are dedicated to improving quality for growers worldwide.

While working to improve phytosanitary measures, cuttings producers have simultaneously been challenged to adapt to market pressures to reduce chemical use on unrooted cuttings, namely in the neonicotinoid class, and implement more integrated pest management and biological controls into production. This isn’t easy, considering the stringent history of zero-tolerance for insects at the border and the constant pressure to provide clean cuttings.

“We have taken neonicotinoids out of our spray inventory,” Neisser said. “Greenhouses in the U.S., Canada, and Europe do not accept cuttings with pesticides of this kind on them.”

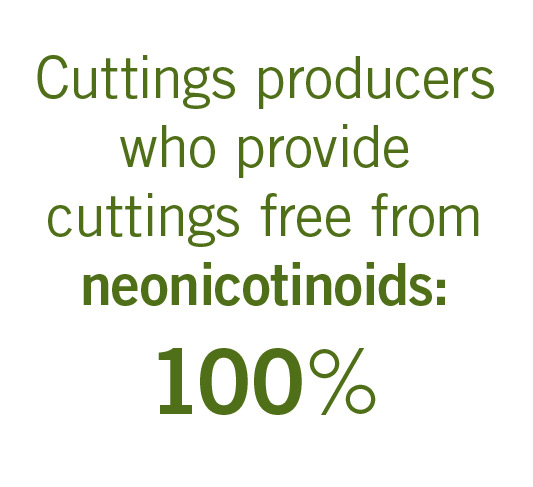

All of the cuttings producers who responded to the 2018 Cuttings Survey said they offer neonic-free cuttings, up from 66% in 2016.

Some producers said the reduction or elimination of the use of neonicotinoids has not affected them or that they have adapted well, while it’s been a bigger adjustment for others.

“Neonicotinoids have been an important part of our IPM program. We had to move to other products,” said Torsten Mundus of Selecta.

Leland Toering of Darwin Perennials said the market demand for neonic-free cuttings has allowed the farm to re-evaluate its pest management program. Robbert Hamer of Florensis agrees, saying that the process was “valued very much, since it levels the playing field.”

“Since the beginning, we have taken the route of crop protection not against nature but with nature,” Hamer said. “Applying Integrated Pest Management has been a steep learning curve, where in some instances our sales have been held back, for example when customs held our shipments when they found beneficial insects. Now everybody needs to adhere to these industry-wide rules and boundaries.”

Several cuttings producers have adopted the use of biocontrols, including beneficial insects, in their crop protection portfolio.

“Beneficials are the main part of our treatments,” Mundus said.

Others say they are looking into using biocontrols, but have been held up.

“We are concerned about the risk of interception of these insects at the border resulting in destruction of shipment, even though they are beneficial,” Mike Klopmeyer of Ball FloraPlant said.

Neisser said, “At this moment, biocontrol is not possible. It is a supply problem in Mexico. But we are in contact with some suppliers and looking into it actively.”

Adoption of biocontrols in cuttings production has dramatically increased since 2016, before the USDA-APHIS pilot program was implemented. Producers said working with USDA-APHIS to increase performance standards at the farm level and certify production locations for pest-free cuttings to facilitate quicker entry of cuttings orders into the U.S. has been a process that “overall works fine” with “very few problems with the authorities.” Producers indicated they are “willing for more inspection from USDA to learn more from each other” and to “help address issues for producers and customs.”

Hamer said he and others from his company have visited USDA colleagues to acquaint them with the company and its philosophy and standards, “and to learn how and why they do what they do.” He adds that for USDA, “IPM is also a learning curve.”

Cuttings Quality Essential to Competitive Industry

Growers consistently report and lament the pest and disease issues from offshore farms that seem to continuously plague the industry, despite cuttings producers’ Herculean efforts to stop this from happening. It’s not something producers take lightly, as quality and service are top priority to serve growers and also remain competitive.

“Because of the big competition pressure, high-quality cuttings became standard,” Neisser said. “You will be replaced very quickly if your cuttings show up with below-standard quality.”

Klopmeyer said, “Quality is improving overall and making for a very competitive market. It comes down to good genetics that are reliably supplied at a fair price. We are concerned about the business health of our customers and the effects of labor and trucking on their businesses.”

Ryan Hall of Syngenta Flowers agrees, saying “The overall flowers market is not growing; therefore, producers not only need to breed products that add value and improve growers’ experiences, they also need to deliver flawless quality and top-notch technical support. We are committed to doing all of these things to support the success of our industry and help drive growth in flowers again.”

Toering said the quality of perennial cuttings shipped into North America has been poor, which provides an opportunity for his company and others to improve quality and bring perennials up to similar standards placed on annuals.

There are bound to be issues in one location or another — whether it’s due to disease, supply, or geopolitical unrest. Due to these challenges, the industry needs to continue to support a diverse supply of unrooted cuttings from various producers, said Troy Lucht of Plant Source International.

“We always have some concern on the consolidation within our industry as it often creates monopolistic supply concerns,” he said. “That may be good for a producer to be the sole source, but if there is an issue, which will happen, it creates chaos for the growers and brokers. Often it is many hours of brokers working with customers to solve the shortages without any additional revenue for the salesperson. There is a certain level of confidence in some breeders’ offerings when they can be purchased from several different production farms. All production farms will have issues at some time, so the diversity of production supply is a relief for many.”

Communicate, Communicate, Communicate!

Cuttings producers ask grower customers to provide constant, quality, timely feedback, both good and bad, to allow for continuous improvement of service and quality.

“We strive to provide the absolute best service, and if we fall short, we would love the opportunity to make a wrong a right,” said Jenny Knapp of Dümmen Orange.

Lucht said, “If there is a problem with URC — count shortage, inconsistent quality — we would really like the customer to take a picture of the URC and the plastic label that was in the bag. That allows us to trace it back to the individual that harvested that bag and discuss ways for improvement. We can improve if we know where to address the issue.”

Neisser agrees with Lucht, saying, “[We need] more contact with us in case of crop problems after sticking. We can look into issues when we know the cuttings are causing problems in the customers’ nurseries.”

Advanced notice from growers for forecasting supply and sharing information on market changes, and retail and consumer demands are other requests from cuttings producers.

In return, producers are working on their own market communication by increasing technical support and freight management staffing, improved customer bulletins when there may be an issue, better cultural guides and scheduling tools, e-commerce ordering, and online availability. Look for more information on specific programs from each producer on GreenhouseGrower.com.