Growers And Suppliers Move Forward With Cautious Optimism In 2016

A year of growth in 2015 also had its share of challenges, and as a result, growers and suppliers are a bit more guarded going into 2016. After a few years of extreme weather and drought, a massive ongoing labor shortage, a shaky economy, and increased government regulation, Greenhouse Grower’s 2016 State Of The Industry Survey shows growers and retailers are moving forward with cautious optimism.

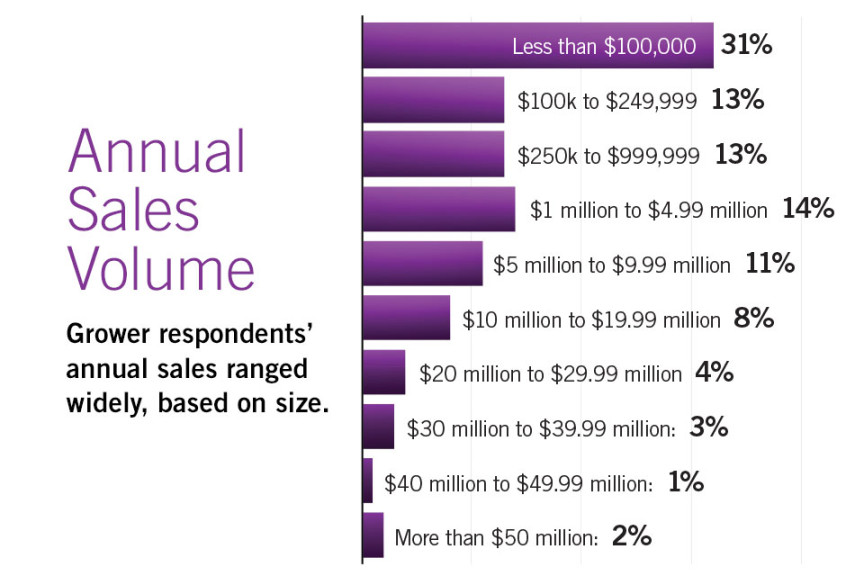

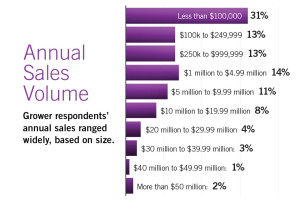

Greenhouse Grower’s 2016 State Of The Industry Survey included separate questions for growers and for suppliers. Of our 358 respondents, 103 were suppliers, 111 were grower-retailers, 109 were wholesale growers, and 35 were young plant growers. Among growers, 57% indicated their operations were small (less than 100,000 square feet), 21% were medium-sized (100,000 to 399,999 square feet), and 22% said they were large growers (400,000 square feet or larger).

[blackoutgallery id=”126522″]Sixty-eight percent of the grower respondents said their sales grew in 2015 over 2014, down from 71% growth in 2014 over 2013. As a result, 58% said they’ll increase production volume in 2016, while 32% said they’ll grow the same volume of crops as last year.

Growth remains constant, as 42% said they plan to add or retrofit a greenhouse structure in 2016, the same percentage as those who planned to build or retrofit in 2015, while 37% said they don’t see a need.

Among those planning to build, the majority are large growers, 67% of whom said they’d build in the coming year, followed by 48% of medium-sized growers and 32% of small growers.

Prices won’t increase overall, as 60% of growers said they’ll keep prices flat over 2015, but a bold 38% said their 2016 prices will be higher. That indicates more cautious growth compared to 2015, when half of grower respondents said they planned to increase prices. Price increases are more common among large growers, with 55% saying they’ll raise prices in 2016.

Growers Are Expanding Traditional Crops And Diversifying Into Emerging Markets

Herbs and vegetables are the largest growth area for growers in 2016, with 42% planning to increase production. Meanwhile, 33% of growers said they plan to grow greenhouse produce in 2016, while another 10% are looking that way down the road a few years. Another 57% said they don’t plan to grow greenhouse produce at all. Looking a little closer, small growers are the ones who are most interested in this segment, with 45% saying they’ll pursue growing greenhouse produce in 2016.

The escalating interest in the cannabis market hasn’t changed drastically in terms of the number of growers looking into production. Just 2% of growers said they’ll plan to pursue growing medical marijuana in 2016, but another 14% said they’ll consider it over the coming years as the market becomes more stable. Another 84% said they have no plans to grow medical marijuana.

Growers seem to be more conservative than suppliers, who indicated that they are optimistic about the opportunities available in the cannabis market, as well as increased expansion into the greenhouse vegetables side of the business.

Container perennials are another growing crop category, as 35% of growers said they’ll increase perennial production this year. Ornamental bedding plants seem to increase in production every year, and this year is no exception, according to 35% of growers who said they’ll grow more annuals. Flowering potted plants will grow in production for 26% of growers, and another 24% said they’ll increase production of their own plugs and propagation material. Woody ornamentals are also increasing significantly among 18% of growers.

Specifically, growers mentioned patio containers would be a growth area this year, as well as drought-tolerant plants and specialty culinary crops like herbs and cut microgreens.

Growers Continue To Reduce Use Of Neonicotinoids

A large number of growers are eliminating use of neonicotinoids in production this year (64% overall), led mostly by small growers (69%), followed by large growers (57%) and medium-sized growers (56%). This has changed from 2015, when growers reported in our survey that 52% would not use neonics, while 48% planned to continue using the class of chemicals.

Large retailers are continuing to phase out plants grown using neonicotinoids, including Lowe’s mandated phase-out by 2019 and The Home Depot’s recent announcement that 80% of its plants are already neonic-free and it will phase out any non-mandatory, regulated use of neonics by 2018.

As a result, these retailers’ grower vendors are being required to reduce or eliminate neonic use, as well. Seventy-four percent of growers who said they supply mass merchandisers and home improvement chains reported they won’t be using neonics in 2016 production. Of those who are still using neonics in 2016, phase out is imminent or in progress.

“We have been working to take them out of use for the past two years, based on customer pressure,” said Ed Van Hoven of American Color.

“We are using more biologicals due to customer demand,” said Karin Walters of Walters Gardens.

“We did not use them in 2015, and therefore spent more on chemicals,” said John Bartok of Corso’s Perennials.

Grower Concerns Escalate Over Labor, Shaky Economy, Government Regulation

The biggest financial pressure, across the board, is labor, labor, labor, with 61% of growers saying this contentious input is the number-one cost placing the biggest burden on their businesses. But beyond cost, labor supply was the most mentioned anecdotally. The labor pool is getting shallower and growers are reaching panic mode.

“I want to have access to qualified workers who really want to work. This past season was the first time we had to rely on a temp agency to fill open positions. The job market is pretty competitive in our area,” said David Holley of Moss Greenhouses.

“Labor is one of the biggest concerns in our industry. Although we have a good resource in H-2A that is volatile due to government regulations,” said Danny Gouge of Willoway Nurseries.

“Quite frankly, if the minimum wage went up to $10 an hour, I would be out of business. How can a small owner deal with this issue? You can only raise prices so much,” said Ara Lynn of Amazing Flower Farm.

The next closest financial concern was energy costs, with 16% of growers expressing financial stress in this area.

“Utilities — gas and electric — are eating me alive, not to mention water. I have been trying to explain the nature of the greenhouse business to the water company. They concluded that my meter was not functioning for several months and added an exhoribitant dollar amount to my bill,” said Jay Stewart of From The Ground Up Greenhouse.

“We are currently at a disadvantage because our natural gas supplier (city municipality) is priced three times higher than the rural supplier for my area. We are having to move early production outside this area and transport for retail sales,” said Patrick Wheatley of Bright Star Nursery.

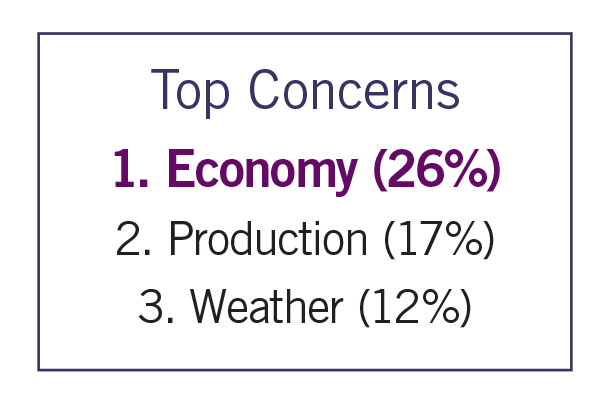

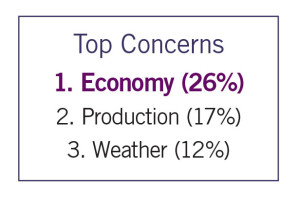

Top concerns going into 2016 for growers are the economy (26%), production costs (23%), government regulation (17%), and (the always constant) weather (12%).

“For us, the economy is big. Our operation is in a good, diversified area. Education, medicine, and manufacturing make up a big part of the local economy. The thing that concerns me is that the federal debt continues to increase, regulation continues to increase, and the workforce is in decline. One of these days, we are going to have to pay the piper,” said Jerome Vite of Vite Greenhouses.

“Government regulation is crushing in California and is forcing smaller producers out of business. Some of them are our customers, and there is no end in sight for California’s addiction to rule-making,” said Roger Smith of TreeSource Citrus Nursery.

Extreme weather in the past several years, from bitterly cold and snowy winters in the past two years to El Niño conditions this year, and extreme drought in the West for more than five years to flooding and wet spring conditions in the East, has many growers concerned.

“Global climate change is certainly going to have major impacts over regions of the country that will significantly impact the role of horticulture within my lifetime. People may be buying prickly pear cactus instead of petunias, and I can’t imagine the sales volume will stay the same,” said a grower at Clesen Wholesale.

Generally, growers said increasing production costs are squeezing margins, and causing stress.

“Fuel prices have dropped dramatically over the past year, yet there is no relief price-wise from manufacturers or distributors,” said Randy Killian of Country Bloomers Greenhouse.

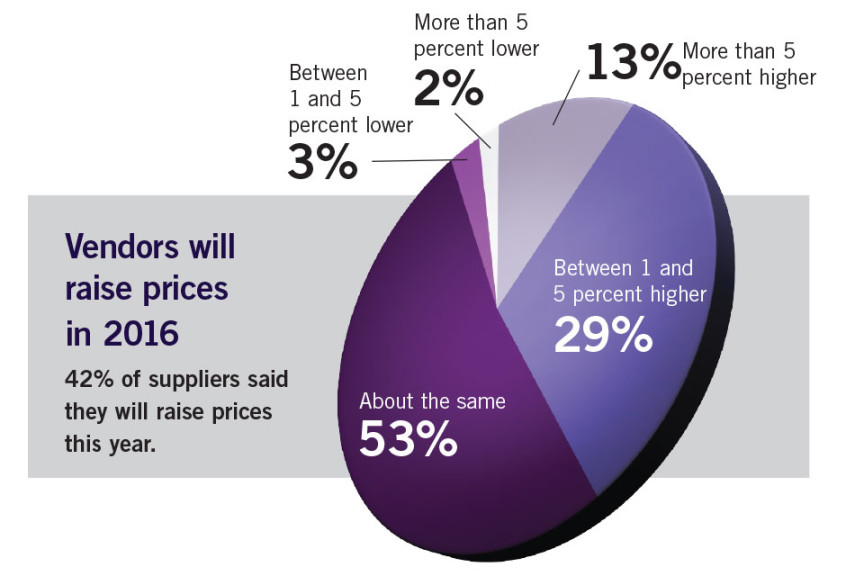

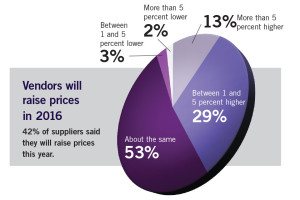

This is not a new problem and certainly won’t go away in the near future. The majority of vendors said they’ll keep their 2016 prices about the same (53%), but 29% said they’ll increase prices up to 5%, and 13% plan to jack up prices by more than 5%.

Growers said other than simply lowering their prices, suppliers could help in other ways to improve their profitability, as well. Chief among the requests are improved supply chain shipping reliability, just-in-time delivery of smaller orders, and improved shipping practices to help growers save on freight costs.

Suppliers know they can help growers reach their goals, and plan to do so in 2016 by educating growers better about their products (55%), improving their product selection (32%), offering early-order discounts (3%), and lowering prices (2%). Improved service, promoting the right product for the right use, and increasing communication on all levels through service, product support, and marketing were among other priorities for helping growers.

Innovations Fuel Grower Optimism In 2016

Despite their many concerns, growers are ready to tackle another spring season in 2016, and many have reported that investments they have made within the past year are helping to drive their operations into the future.

“We selected and trained our seasonal staff with a different strategy, and hired great sales and greenhouse managers. We also started adding technology to our operation,” said Jeff Prior of Dakota Greens and Custer Greenhouses and Nursery.

“We have seen increased productivity due to a new cylinder seeder. We’re eliminating a few minor crops and doing a better job with the remaining,” said Deb Perillo of JJL Greenhouse.

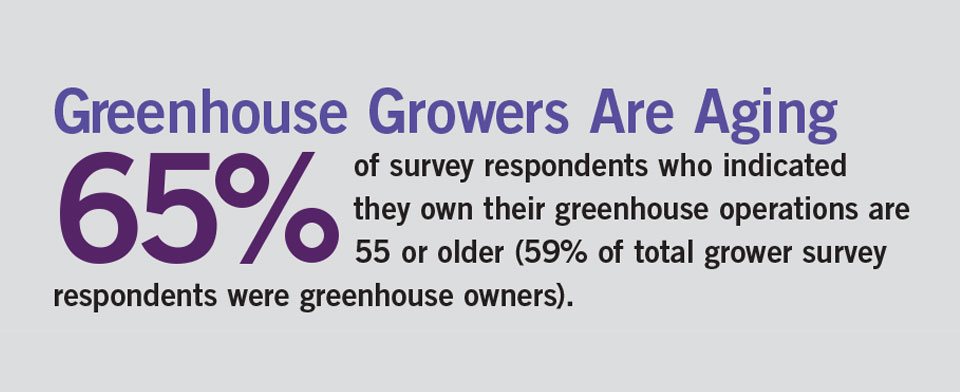

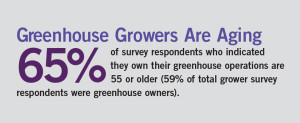

Several growers reported this spring season may be their last before retirement.

“We still have a great profession in a great industry, growing beautiful things and living comfortably. It’s great to have children taking over the business,” said James Gapinski of Heartland Growers.

Increased consumer confidence indicates good things for 2016, growers said.

“It seems people are finally letting go of money more freely. Spring was good, fall was the best landscaping season we have had in 10 years, and Christmas started with a bang with record numbers for all the open houses in the area. This makes us very optimistic for the upcoming spring season,” Wheatley said.

And we agree with the grower at Clesen Wholesale, who succinctly said, “What a great time to be in horticulture!”

See more statistics and information at a glance from Greenhouse Grower‘s 2016 State Of the Industry report.