Dr. Charlie Hall’s Economic Outlook for the Greenhouse Sector in 2024

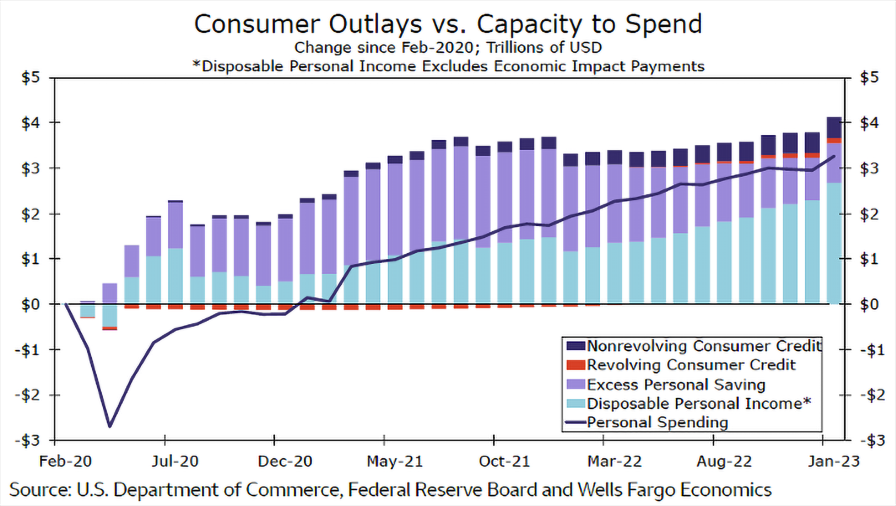

Disposable personal income has been on the rise consistently since the spring of 2022. Graphic: Charlie Hall

The demand for greenhouse crops has been stellar in recent years due to the greater time that people spent in and around their homes. This translated into the expected shot-in-the-arm effect we’ve seen in historic downturns (which I have written about many times before), but I don’t think anyone (including myself) expected for lawn and garden expenditures to increase as much as they did. It caught our entire “just-in-time” green industry supply chain by surprise, and we paid the price in terms of logistics, firm-level standard operating procedures (SOPs) ensuring employee and customer safety, and escalating input costs.

Sales (and profits) were hindered in 2022 mostly because of weather effects and a late spring in most parts of the country, and 2023 was also a mix in terms of performance, according to surveys I conducted of firms that are alumni of my Executive Academy for Growth & Leadership (EAGL) program and/or participating in my YourMarketMetrics benchmarking program. Most (about 75%) of growers saw year-over-year comparisons increase, while only 65% saw comparison increases in net profit. Follow-up with those reporting increases in sales showed that much of the increase was due to the increased prices that were implemented in the wake of input cost increases, and that units sold either held steady or decreased compared to last year.

Looking forward into 2024, there are three main things I am paying close attention to: 1) the general state of the economy, 2) the outlook for the housing market, and 3) the capacity of consumer spending and whether it will continue at the same pace.

The economy has remained remarkably resilient this year, withstanding the initial shock of rapidly higher interest rates better than most analysts anticipated. And this has to do with the traditional lags associated with monetary policy, as well as just a robust amount of spending power in the household sector. Real GDP, for example, expanded close to about a 5% annualized rate in the third quarter alone. But that said, I still expect there is a chance of the economy weakening over the next 12 months. What I’m more certain of is that growth will be slower in the next few quarters. But even if the economy does fall into a recession, it likely won’t be too deep or last very long. Unlike prior to the financial crisis in 2008, the household sector isn’t overly levered at this point and the banking system is still well capitalized today. So I think that ultimately leaves the economy in a much better position headed into a potentially subpar year of growth in 2024.

Housing Market Booms

This is where the first bright spot comes into play. Over the past 15 years, we have not built enough homes to keep up with growing demand. The problem has intensified during the pandemic, with demand skyrocketing because of the shift to working from home and the availability of historically low mortgage rates. At the end of 2021, the U.S. was about 3.5 million homes short of the number required to maintain a stable market. Together with the rising cost of building materials, the depleted supply of new homes has pushed housing prices to record highs, contributing to a rate of inflation not seen in more than 40 years.

To close the gap, the U.S. housing market will need around 1.7 million new homes on average each year until 2030. This figure is calculated based on demographic trends, current economic conditions, the cost of living, and a long-term growth forecast of 1.8% annually.

Given that there were only 1.6 million new housing starts last year, when the market was booming, it would be nearly impossible to rely on the private sector alone to deliver such a high level of new homes each year, especially as the market for housing has cooled sharply. Government agencies at the national and local levels will need to take a more active role to overcome the current housing deficit by adopting policies that include more flexible zoning restrictions, expanded housing tax credits, and provisions that broaden affordability.

Consumer Spending is High

The second bright spot is related to consumer spending. The economy has shown resilience in the face of rising interest rates as consumers, bolstered by excess savings built up during the pandemic, have continued to spend. The staying power of the consumer remains a front-of-mind consideration for Federal Reserve Bank policymakers (and financial markets alike) these days amid a rising sense that the next rate adjustment could be down rather than up. It is well understood that inflation needs to be coming down closer to the Fed’s target before it can initiate such a pivot, and this cycle has proven that it’s tough to get businesses to lower prices when consumers are still aggressively spending, that may be changing.

Even as the job market softens somewhat, income growth has continued. There is still income excess liquidity that consumers are spending down and expenditures on revolving credit is creeping up. But as I have said before, expenditures rise to meet income and right now, consumers have the ability to spend on your greenhouse crops in 2024. We just have to continue to remind them of the reason to do so (e.g., health and well-being benefits).