Running a Greenhouse? Watch Your Capital Expenditures (Opinion)

One of the best analogies I have heard about life is that it is like a train ride. You get on at your stop. You travel through hills and valleys, see majestic scenery and barren landscapes, and experience stops and starts. Passengers come and go. Delays are inevitable; sidetracks a given. Thrilling bursts of speed are a bonus. When your time comes, you get off. From birth to death, life is a journey, not a single destination. This analogy is a good one to remember in times of prosperity.

One of the best analogies I have heard about life is that it is like a train ride. You get on at your stop. You travel through hills and valleys, see majestic scenery and barren landscapes, and experience stops and starts. Passengers come and go. Delays are inevitable; sidetracks a given. Thrilling bursts of speed are a bonus. When your time comes, you get off. From birth to death, life is a journey, not a single destination. This analogy is a good one to remember in times of prosperity.

What we do today, we must live with tomorrow. Across the board, greenhouse growers, for the most part, are enjoying a great couple of years. It’s a cause for celebration and a fun time to be in the industry. It’s a time to think about growth; a time to make plans, to expand, even to speculate a little. Only, let’s keep things in perspective.

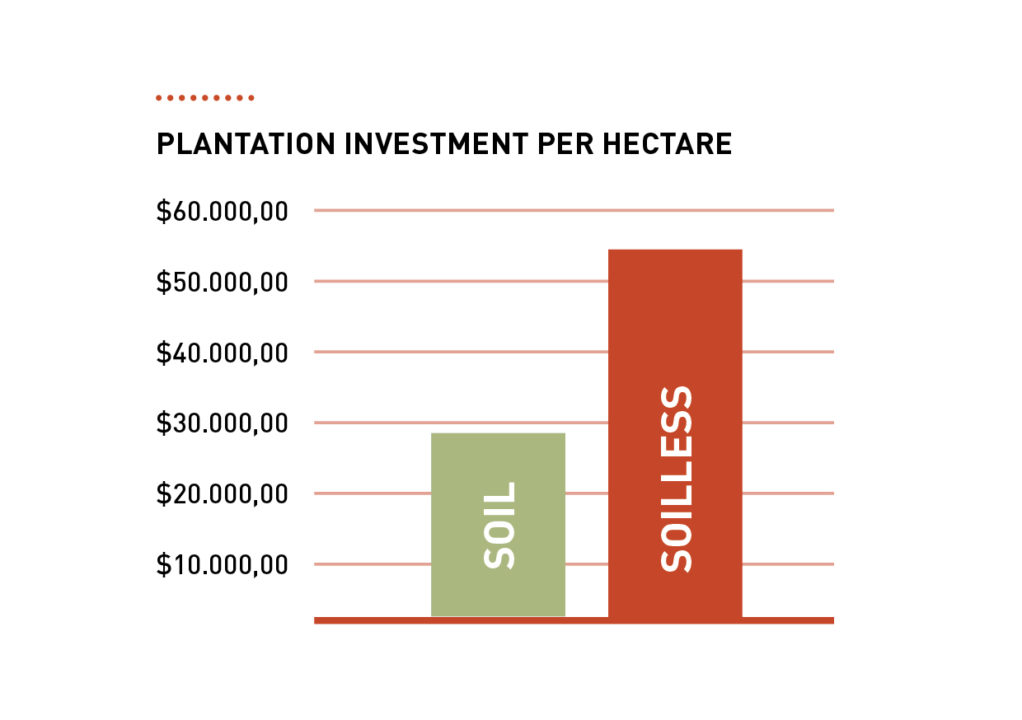

Chris Higgins, President and Co-founder at Hort Americas, got me thinking about this during a recent conversation where we discussed the state of the greenhouse fresh-produce industry for an article I was writing. He said one of his biggest concerns today is that margins in vegetable production in all agriculture, whether it’s greenhouse or field, are narrow. Building a greenhouse costs more today than it did two years ago, so growers need to be cautious about what they are spending on the capital expenditures (CapEx) side to give themselves a chance to be competitive down the road as the market fluctuates.

“Whatever we put in today in the CapEx side, we have to live with for the next 10 to 20 years. That number won’t change,” he says. “If I were building a greenhouse today, I might tap the brakes a couple of times and say ‘Ok, where are we at with the cost of steel? What about freight and logistics? How do these things really affect our CapEx, and can we truly afford the increase and the impact it will have on us over time?’”

I think these are fair questions wise-minded growers need to ask themselves. After all, CapEx is an investment to secure future profitability. Accounting 101 tells us that funds spent on capital expenditures don’t immediately show up on a business’ income statement. Rather, they are treated as assets on a balance sheet that are deducted over time as depreciation expenses. The longer the depreciation expense stays on the books, the longer it affects bottom-line profits. So, here’s a gentle reminder. There is nothing wrong with enjoying the prosperity the greenhouse industry is currently experiencing and planning for your business to grow and expand. The best thing any grower can do right now is to use this period to solidify their business for the long-term.

However, if over-expanding or over-extending yourself moves you beyond your company’s financial resources, your whole business could be at risk. One way to help avoid this scenario is to pace your growth and expansion using your three- to five-year financial projections and strategic plan as your guides.

Let’s celebrate the fact that things are going well for the industry, but for the good of our future, please don’t let this temporary destination distract you from the overall journey.