Why Quality and Consistency Are Prerequisites to Profitability in Greenhouse Produce

“More crop categories will transition to controlled-environment agriculture dominance, as we have already seen with greenhouse tomatoes,” says Caroline Nordahl, Chief Sales and Marketing Officer at Bluelab. “As we see more variety become available in microgreens, sprouts, snack varieties, and more, growers will have the opportunity to distinguish their greenhouse produce brands in grocery stores, garden centers, and nurseries.” Photo: Yong Wang/Pixabay

Growth, investment, consolidation, new alliances — it’s all happening right now in the greenhouse fresh-produce market. Consumer demand for locally sourced, year-round produce has driven growth in this exploding market, which is well-poised for expansion. COVID-19 has only accelerated developments in this market, highlighting the benefits of controlled-environment greenhouse production and underscoring the need for more multiplicity when it comes to fresh vegetable production, both in where and how vegetables are grown.

“Overall, we predict strong growth for the greenhouse fresh-market vegetable industry in the next five years, powered by consumer demand and the advantages of controlled-growing methods versus field agriculture,” says Caroline Nordahl, Chief Sales and Marketing Officer for Bluelab. “Consumers care about flavor, safety, and nutrition, and these are strengths of greenhouse operators thanks to tighter control not just over crops, but also supply chains, which are increasingly efficient and traceable.”

Plenty of Room for Everyone

There is plenty of room to accommodate growth in the greenhouse vegetable sector to meet consumers’ consumption, needs despite imports from Canada and Mexico and the vast amount of field acreage devoted to vegetables. And, when you look at consumers’ desire to purchase fresh-produce closer to where they consume it, recent concerns with food safety issues in lettuce and tomatoes, and the general benefits of growing in a greenhouse from a natural resources and labor standpoint, the outlook for fresh-produce greenhouse growers is bright.

Two factors driving growth in this sector have to do with the need for the U.S. to end its reliance on one type of vegetable production. If there is one lesson people managing the food supply chain learned during the COVID-19 crisis, and more recently with California growers’ struggles with water availability, it’s that diversification is a good strategy.

“As they [field growers] have less water available to irrigate their fields and as the climate changes in such a way that they’re not able to grow some of the same things they’ve been able to grow, we need somebody else to pick up that slack,” says Tami Van Gaal, CEA Division Leader at Griffin Greenhouse Supplies. “The U.S. population isn’t going to just stop eating lettuce and strawberries. So, when our food bowl areas can no longer produce, it needs to spread out a little bit. But also, from the perspective of people managing that food supply chain, it makes a lot of sense to spread the risk, so to speak, because we can’t have everything dependent on what happens in the Central Valley in California.”

While field-grown vegetables, many grown in California, still make up a major portion of the nation’s food supply, food safety issues have plagued this side of the market. This is where greenhouses can shine, because if your food is spread out over several greenhouses instead of one big field, the batches coming out of those are going to be smaller.

“Even if you do have a problem and you’re tracing back and you have a recall, it’s a smaller amount of material that would have to get recalled,” Van Gaal says. “It leads to less risk because we’re spreading out the production site. But it also does raise the bar for the producers.”

Consumer demand for locally sourced, year-round produce has driven growth in this exploding market, which is well-poised for expansion. Photo: Griffin Greenhouse Supplies

Time to Up the Ante

Maintaining and moving to higher standards is exactly what greenhouse producers will need to do to remain competitive and secure full-year contracts.

“As retail grocery operations become more localized, greenhouse growers will face increased pressure to maintain consistency in quality and supply,” says Dr. Abhay Thosar, Director of Horticulture Services at Fluence by OSRAM. “Year-round food production will no longer be a stretch goal. It will be a prerequisite to profitability.”

Chris Higgins, President and co-founder of Hort Americas, shares similar sentiments to Thosar.

“When you pull back all those layers of the onion and you look at the produce buyer as the person who truly controls what ends up on the shelf, they will want to know what our ability is to provide high-quality products 365 days a year that are consistently the same grade as possible,” he says. “The biggest question for the greenhouse-produce industry needs to be, how do we make the supply chain more reliable and consistent, while outperforming the field grower on a daily basis on quality.”

Thosar says that how grocers supply tomatoes, cucumbers, leafy greens, and other produce is quickly catching up to consumers’ preferences for locally sourced food. Retail grocery chains are already consolidating greenhouses in their areas of operations to deliver consistent quality along with a more consistent supply of fresh food. In the coming years, a more localized approach to food production won’t just be normal, it will be the standard. He adds that in the future we’ll continue to see retail grocery chains expand their portfolio of local greenhouses and vertical farms.

“It’s increasingly common for grocery retailers to offer salad greens that were just harvested nearby,” Nordahl says. “At some point, we’ll move beyond the novelty of this high-value retail experience to measuring benefits associated with simpler, shorter supply chains and safer, better-tasting food.”

By the Numbers

Greenhouse agricultural production currently accounts for 1% to 2% of the agricultural production in the U.S., but is rapidly growing. The value of this greenhouse production has increased 44% in the last few years, and the number of operators has gone up by 71%, according to Fidel Maureira, Ph.D. Candidate in the Department of Biological Systems Engineering at Washington State University and author of the online article “Greenhouse Production of Vegetables: Implications for the Region”. The number of greenhouse vegetable farms reported in the 2017 USDA Agricultural Census numbered at 10,849, up 19% from 8,750 reported in 2012. Acreage increased as well, with 2,584 acres devoted to growing vegetables and fresh-cut herbs, compared to 2,250 acres in 2012.

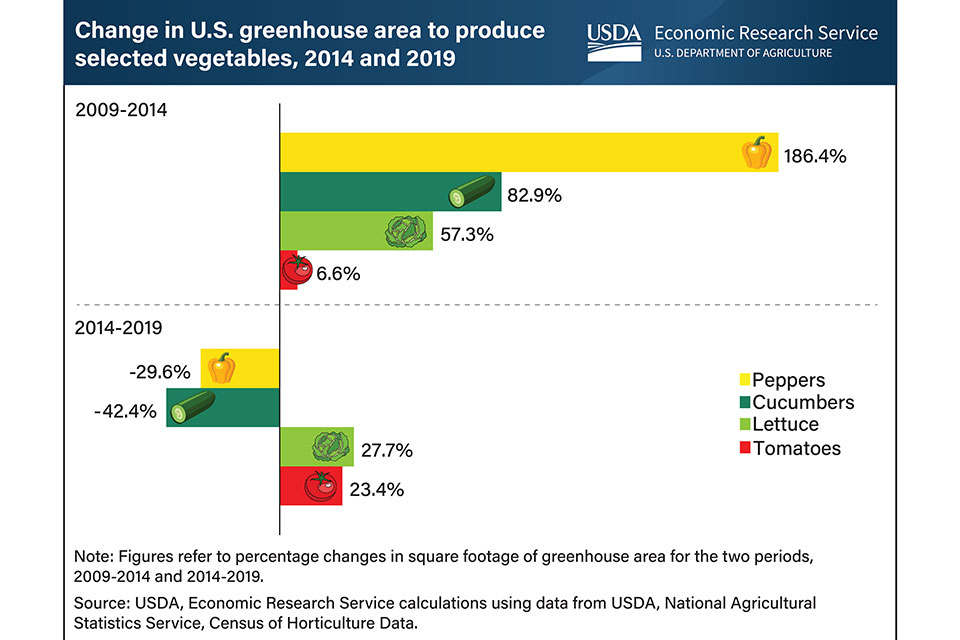

Greenhouse area devoted to cucumber and pepper production in 2019 was down 42% and 30%, respectively, compared to the change between 2009 and 2014, according to the USDA Economic Research Service’s April 2021 Vegetable and Pulses Outlook (refer to chart above). In contrast, lettuce and tomato protected culture area was up 28% and 23%, respectively, over the same period.