What to Know When You’re Applying for CARES Act Funding

Since the passage of the Coronavirus Aid, Relief, and Economic Security (CARES) Act in late March, small businesses have had a chance to apply for financial relief for their operations. A large portion of that relief comes from the Payment Protection Program, which addresses employee earnings and some other expenses (the application window for this program opened April 3).

In the short time that has passed since then (although for some, it may seem like much longer), there has been some clarification from the Small Business Administration (SBA) in how businesses are covered, how loans are paid out, and more. In response, AmericanHort recently hosted a follow-up webinar featuring insights and advice from its partner organization K-Coe Isom, an agriculture consulting and accounting firm. K-Coe Isom Federal Affairs Lead Brian Kuehl and Senior Associate Kala Jenkins once again led the discussion (for a recap of what was presented in the first webinar, click here).

Here are just a few things you should know from Kuehl and Jenkins’ presentations.

- The Payment Protection Program of the CARES Act currently includes nearly $350 billion in available funds, although Kuehl predicts that another wave of funding could soon come that would increase it to $600 billion. Even with that increase, there is speculation that with the high number of businesses who have applied or are expected to apply for funding, the dollars could run short quickly. While it’s not necessary to rush out to apply, Kuehl suggests not hesitating too long.

- Eligibility update: This past Monday, SBA added provisions that allow businesses to qualify for funding if their net worth is not more than $15 million, and their average net income for the last two years is less than $5 million.

- Employee head count clarification: Eligible companies must have fewer than 500 full-time, part-time, and temporary employees. From this number, H-2A workers are not included, which could help many more horticulture businesses qualify.

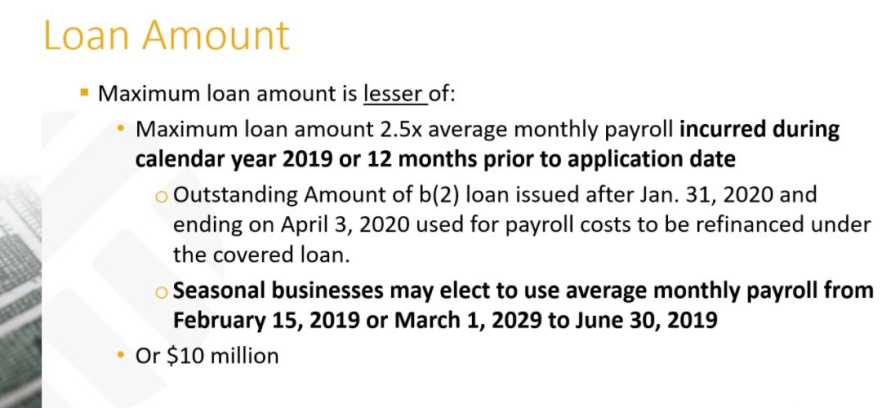

- The image below outlines the loan amount businesses would qualify for.

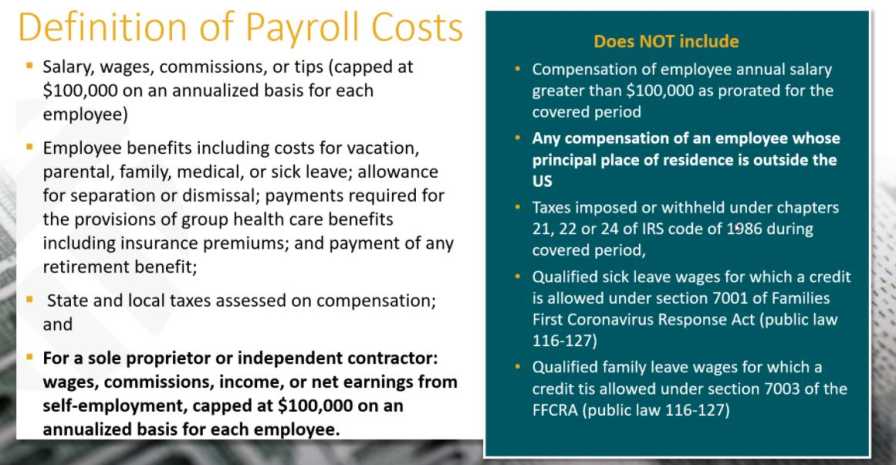

- Another image below outlines how payroll costs are defined.

- While H-2A workers are not included among a company’s employee head count, funds received from the Payment Protection Program can be used to pay H-2A workers. However, these funds may not be forgiven.

- Since April 3, most lenders are up and running in terms of processing loan applications, although some are still setting up online portals with SBA. Additionally, Jenkins notes that some lenders might require more documentation than others, based on their risk assessment. “Some banks might also provide payments in one lump sum, while others might offer multiple disbursements,” Jenkins says. “My advice would be to start with your local lender first, but seek out another lender if you feel you’re not getting a quick response.”

- Kuehl says that with a very high backlog in applications, some are concerned about delays in the process. “Make sure your application is not lost in processing,” Kuehl says. “These dollars are really a lifeline for your business, so continue to push if you need to.”

You can watch the complete webinar, and download a PowerPoint slide deck, here .