Supply Chain Issues Require Creative Plant Health Solutions

Photo: Live Earth

Russell Taylor, Vice President of Live Earth Products, recently described the compounding fertilizer supply chain issues as “a bad situation that got worse.” The supply of various components for fertilizer, including nitrogen, urea, phosphates, and potash, were already limited in 2021, but the Russian invasion of Ukraine early this year exacerbated the problem, he says. With limited supply and higher prices, growers may turn to soil conditioners and microbial food to increase efficiency and minimize costs.

Diminishing Supply Driving Prices Higher

Prior to the war, trade embargoes were imposed on nitrogen and phosphate fertilizers because some were subsidized and dumped, a form of price discrimination. It occurs when a manufacturer decreases the price of a product in a new, foreign market to lower than what it costs to produce it on the fair market.

China, a major exporter of phosphorus and urea, took its products offline mid-2021, further restricting the supply and driving prices up. China closely followed Russia as the world’s largest exporters of fertilizer, according to Alex Ramos, Marketing Manager of Haifa North America, a global supplier of specialty plant nutrients, and potassium nitrate for agriculture and other industries.

He says the war added stress to an already strained supply chain. Raw materials were in a tight supply situation, Ramos says, and the sanctions have caused a greater shortage. For example, he says ammonia is derived from Russian natural gas. Nearly 40% of the global potash supply comes from Russia and Belarus, so the war will have a significant impact on availability and pricing. Russia is the world’s No. 4 nitrogen producer, No. 3 phosphate producer, and No. 2 potash producer. That fertilizer is no longer available on the market because of trade embargoes, Taylor says.

“What you see now is a perfect storm with China bringing product offline and Russia’s self-imposed limit on fertilizer exports, which hit back in March,” Taylor adds.

Ramos says the war impacts everyone in the crop nutrient business. It limits the production movement and fertilizers and the raw materials to make them. This supply limitation is driving prices higher, he says.

“The war will have an impact on greenhouse growers as the water-soluble fertilizers are impacted by the production and trade flow disruptions,” Ramos says. “Growers should expect to see higher priced materials. Ordering ahead is an option to overcome shortages, but it will also strain an already stressed supply chain as product availability is already limited.”

Mark Jeffries, Vice President of Masterblend, a company offering fertilizers for greenhouses, nurseries, and hydroponics, says Russia is a significant source of phosphate ingredients used in water-soluble fertilizers. He says there is a “big squeeze” on monopotassium phosphate and monoammonium phosphate.

“Prices are steep, and continue to grow, and it is possible that there will be shortages in the coming months,” Jeffries says. “Masterblend has planned for this and should be able to adequately supply our customers this year.”

Ramos says Haifa’s fertilizer components are sourced globally, but most come from Europe and the Mediterranean region. Taylor says Live Earth’s raw material is humic, which is mined in the U.S. Its other ingredients, such as potash and phosphate, are sourced locally in Utah and Idaho, respectively.

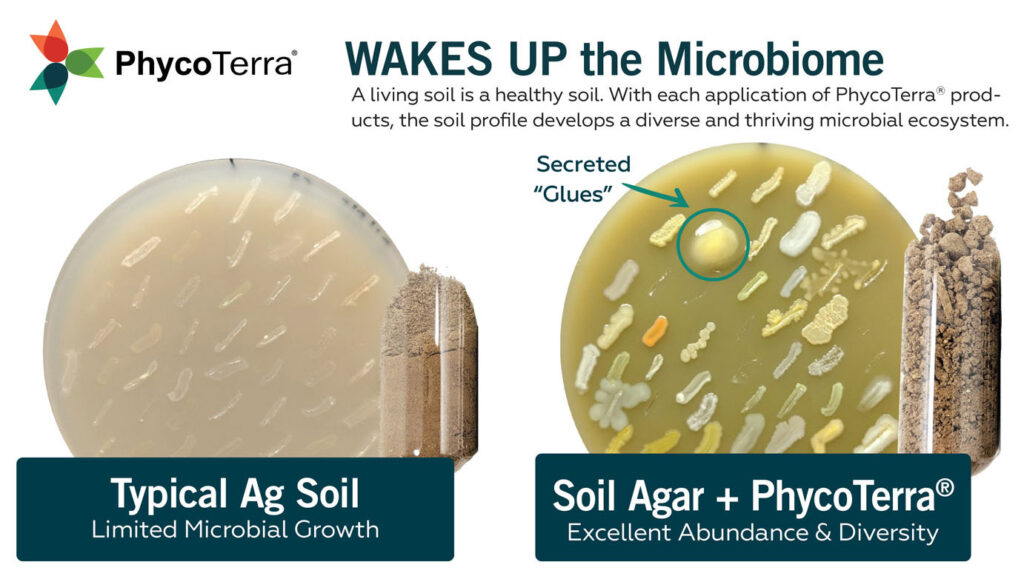

Photo: Heliae

Increasing Efficiency Part of the Solution

As fertilizer becomes harder to get and more expensive to come by, growers will need to incorporate alternative solutions into their programs to effectively manage their nitrogen and other fertilizer needs, according to Dr. Karl Wyant, Vice President of Ag Science at Heliae. He says growers will need to extract every bit of yield per unit of applied fertilizer this year to help justify the input cost. Optimizing the yield per unit of applied fertilizer is broadly referred to as fertilizer use efficiency (FUE).

“As growers feel the squeeze with rising fertilizer prices and scarce availability, careful nutrient management and an emphasis on soil health will be critical for yield success,” Wyant says.

Heliae offers PhycoTerra soil microbial food to boost fertilizer use efficiency and support yield goals by supporting natural processes that benefit the crop. Wyant says PhycoTerra has a unique mode of action that activates the soil microbiome, which ultimately leads to improved soil health, increased water holding capacity, and nutrient mineralization, all of which affect yield.

“Growers interested in adding organic matter and/or biostimulants to their crop input to optimize the fertilizer they have can reach out to their local Extension office or crop adviser to help understand which biostimulants work best with their crop and their soil type,” Wyant says, adding that emphasizing soil health will pay dividends for growers now and in the future.

A diminishing fertilizer supply and rising prices will lead growers to find ways to increase their efficiency, Taylor says. Live Earth offers soil conditioners, made of humates and humic acids.

“Humic acids help retain nutrients and help retain water,” he says. “The goal for most growers using products like ours is to impact efficiency.”

Regenerative agriculture concepts, including improving soil quality, apply to humates and humic acids, Taylor says. Commercial growers seek humic acid products to improve their return on investment. He says the ease of use, availability, and stability make humates a favorable choice for growers.

“There’s a growing trend toward regenerative agriculture and care for the soil. A lot of the things we’ve been able to enjoy are because of cheap commodity prices,” Taylor says. “It’s OK to be inefficient if there are low prices. But as the prices go up and ingredients get more expensive, people really want to start looking at their efficiencies. They’ll say, ‘We can’t be as wasteful as we used to be.’

“I think that’s the future. It’s not just caring for the soil; it’s reducing runoff into our oceans and lakes. This is the care we should have had for our soil years ago. Humates and humic acid are part of that story. If we use less, we lose less. We need to be more cognizant and aware of our nutrient uses and how this impacts the environment.”