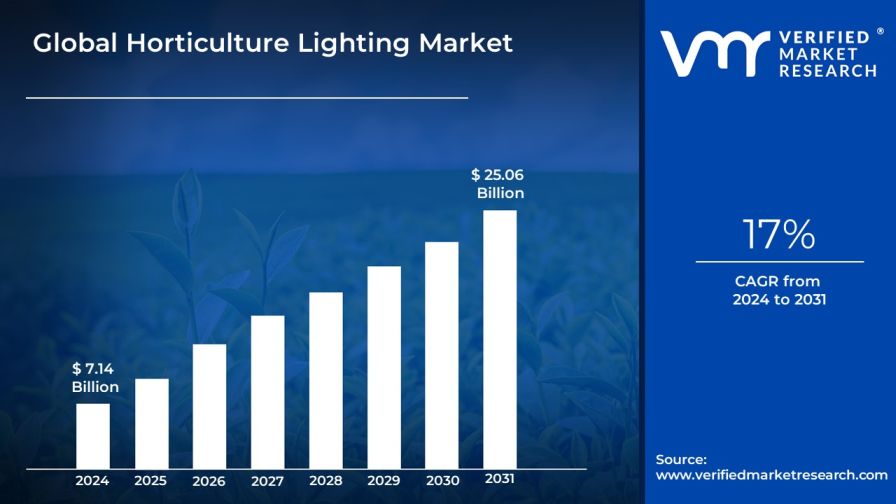

Horticulture Lighting Market to Reach $25 Billion by 2031

The size of the global horticulture lighting market is projected to grow at a compound annual growth rate (CAGR) of 17% from 2024 to 2031, according to a new report published by Verified Market Research. The report reveals that the market was valued at $7.14 billion in 2023 and is expected to reach $25.06 billion by the end of the forecast period.

The horticulture lighting market is evolving rapidly as growers turn to energy-efficient lighting solutions to improve crop yields. This shift is largely propelled by the growing popularity of vertical farming and the need for sustainable food production practices. Insights from the report include:

Key Market Drivers

- Rapid Growth in Indoor Farming and Vertical Agriculture: The global vertical farming market grew by 85% from 2020 to 2023, reaching $4.8 billion. Indoor farming facilities increased by 58% in urban areas between 2020 and 2022. Investment in controlled environment agriculture reached $2.9 billion in 2022, with 45% allocated to lighting systems.

- Cannabis Legalization and Commercial Production: Legal cannabis cultivation facilities increased by 72% from 2020 to 2023 across North America. Licensed cannabis producers reported a 65% increased yield using advanced LED lighting systems in 2022. The European medical cannabis market grew by 92% between 2020 and 2023, driving horticultural lighting demand up by 48%.

- Food Security Initiatives and Year-round Production: USDA reported a 55% increase in greenhouse operations from 2020 to 2023 for year-round vegetable production. The EU’s Farm to Fork Strategy led to 38% growth in controlled environment farming between 2020 and 2022. Urban food production using artificial lighting increased by 62% globally from 2020 to 2023.

Key Challenges

- High Initial Investment and Operating Costs: LED horticultural lighting systems cost increased by 25% from 2020 to 2023, averaging $200-$350 per square foot. Energy costs for indoor farming facilities rose by 32% in 2022, with lighting accounting for 65% of total energy consumption. Small-scale farmers reported 38% lower adoption rates due to installation costs averaging $45,000 for 1,000 square feet in 2023.

- Technical Complexity and Lack of Skilled Personnel: 65% of indoor farming operations reported difficulties in optimizing light recipes in 2022. Training costs for lighting system operators increased by 45% between 2020 and 2023. 72% of greenhouse operators cited a lack of technical expertise as a major barrier to adoption.

- Energy Grid Limitations and Environmental Concerns: Indoor farming facilities reported 28% higher electricity costs in 2022 due to grid capacity constraints. E-waste from LED fixtures increased by 35% from 2020 to 2023, raising environmental concerns. 42% of facilities faced power supply issues affecting lighting system operation in 2022.

Key Trends

- Smart LED Technology & IoT Integration: Smart LED adoption in horticulture increased by 78% from 2020 to 2023. Connected lighting systems reduced energy consumption by 45% in commercial greenhouses during 2022. Investment in IoT-enabled horticultural lighting reached $3.2 Billion in 2023, up 62% from 2020.

- Customizable Spectrum Technology: Facilities using spectrum-tunable LEDs reported 35% higher crop yields in 2022. Research institutions developed 28 new light recipes between 2020 and 2023, improving crop-specific growth by 52%. Multi-spectrum lighting systems adoption grew by 85% in commercial greenhouses from 2020 to 2023.

- Sustainable and Energy-Efficient Solutions: Solar-powered greenhouse lighting installations increased by 95% between 2020 and 2023. Energy-efficient LED systems reduced operational costs by 38% compared to traditional lighting in 2022. The carbon footprint of indoor farming operations decreased by 42% with new lighting technologies from 2020 to 2023.

Additional Report Highlights

- Market Size and Forecast: In-depth analysis of current valuation and expected CAGR through 2031.

- Growth Drivers: Explores how sustainability, vertical farming, and tech innovation fuel demand.

- Regional Analysis: Detailed insight into North America, Europe, Asia-Pacific, and emerging regions.

- Competitive Landscape: Profiles of key players, their strategies, and recent developments.

- Technology Trends: Covers LED, HPS, and new adaptive lighting technologies.

- End-User Segmentation: Insights into commercial greenhouses, indoor farms, and research centers.

Why This Report Matters

This report equips industry stakeholders with actionable insights, enabling strategic decision-making based on technological trends, regional opportunities, and competitive benchmarking in the horticulture lighting space.

Who You Should Read This Report

Ideal for lighting manufacturers, agritech firms, greenhouse operators, B2B buyers, venture capitalists, and policymakers seeking data-backed insights for investment and innovation in horticultural practices.

For more information or to download the full report, please visit the Verified Market Research website.