Cannabis Demand Stays High During COVID-19, But Grower Workflow Changes Likely Necessary

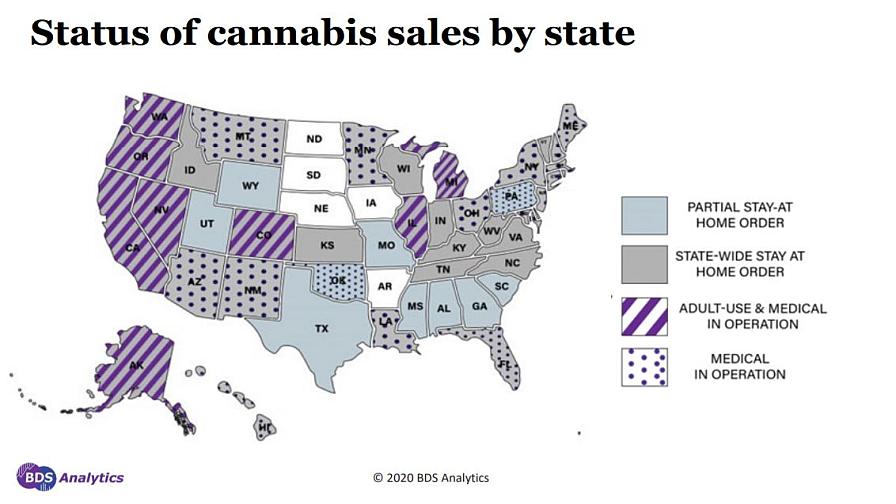

This graphic shows the various state status of legal and medical cannabis sales per state during the COVID-19 crisis. (Image Courtesy – BDS Analytics)

Everyone is trying to find their bearings in this new post-COVID 19 world we all suddenly find ourselves stuck (at home) in.

The cannabis industry is no exception. It’s been a bit of a mixed bag thus far for growers.

On one hand, most if not all legal markets (33 in total last we checked) have deemed cannabis an essential business, allowing both growers and retailers to remain open as long as they practice proper social distancing and follow the “Stop the Spread” protocols. That led to increased sales volumes from mid-March into early April both at wholesale and in retail dispensaries, with some of the more developed markets like California and Colorado reporting upwards of 30% increases in total cannabis sales volumes for the same period year over year.

However, shelter-in-place orders have spread and become more restrictive in places like the Bay Area and other large metros, and many cannabis retailers have been constrained to delivery or curbside pickup options only. And that’s not to mention the lack of canna-tourism hampering sales in markets like Las Vegas, where revenue increases depend on a steady stream of new customers.

And, although it seems cannabis growers are getting a little tired of being reminded of this fact, it bears mentioning that any aspect of the industry that is considered “plant touching” is basically left out in the cold when it comes to the various relief packages other legal industries are able to participate in. So packaging and other ancillary product producing companies may be eligible for some government relief, but if you’re growing plants, you can pretty much forget that entirely.

Still, cannabis growers are mostly keeping open minds going forward. Many that we’ve spoken with in the last couple weeks are just happy to still be able to grow and keep their crews working as unemployment shockingly blows past the 25 million mark for the first time in many of our lifetimes.

“I will say I am surprised at how dramatically and how quickly the situation has changed and evolved over the past few weeks, and just the sheer scale of the responses across the various government agencies both state and federally, as well as seeing all of the various reactions in the financial markets. It’s really been kind of breathtaking (to behold),” says Copperstate Farms CEO Pankaj Talwar.

Copperstate, the largest cannabis growing greenhouse operation in North America and also the subject of Greenhouse Grower’s upcoming June issue cover story, has remained up and running throughout the ordeal. Managing Director J Fyfe Symington IV has some thoughts on how COVID has impacted most cannabis growers thus far.

“I think that the industry is obviously going to have its issues, just like any aspect of the economy when it goes into a recession and you hit double digit unemployment,” he says. “One thing we have going for us is there will always be this very strong underlying demand for our product. It puts us at ease after a long, tough day and there is just so much stress and uncertainty in the world right now.”

While recognizing that overall demand saw a bit of a dip in the immediate aftermath of the shelter-in-order implementations, that’s not a trend Fyfe sees continuing for the long term.

“Where I see this affecting a lot of growers is in adding extra work to their day-to-day that will focus on keeping employees safe and healthy, whereas before it was mostly all about the plant and staying on production schedules,” he says. “In some ways, I could definitely see that hampering production a little for some. And then there will be the supply chain issues; those are going to be tough for anyone to avoid.”

Mainly, growers will need to ask themselves (hopefully for most this process has already taken place): ‘Where is my packaging coming from? What about all my plastic pots? Are they coming from China, and will we run out soon, or will we be able to find someone domestically to fill that order?’

“I’d say right now we aren’t expecting any demand issues, but what we are seeing is having to maintain production with much smaller crews,” Fyfe explains. “You need a lot of people to trim flower when you’re harvesting, and usually those people are working in proximity, shoulder-to-shoulder. Now we need to keep those trimmers spaced out, and do the same job with less trimmers, so just dealing more with situations like that.

“It’s certainly going to be interesting, there’s no doubt about that.”