How Is the Greenhouse Cannabis Market Trending for 2023?

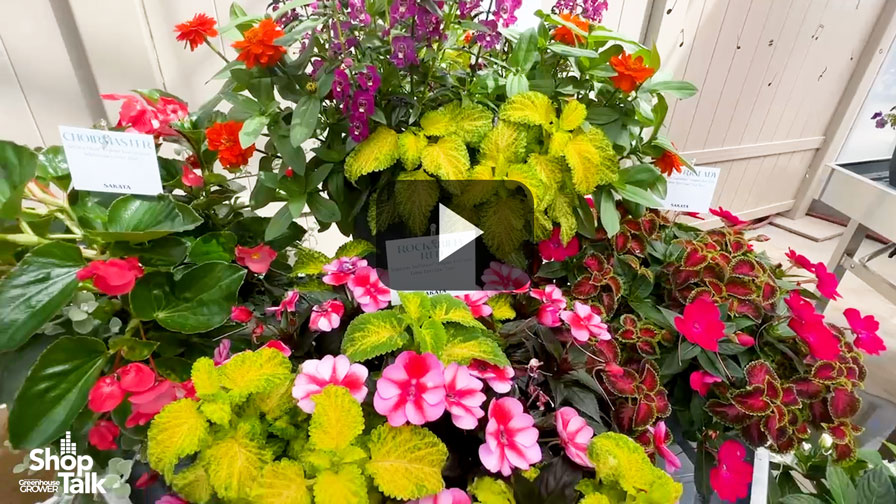

Photo: Gretchen Schimelpfenig

Note: Gretchen Schimelpfenig, Senior Energy Engineer at Energy Resources Integration, is always in tune to the latest developments in energy efficiency and optimization for the controlled-environment agriculture industry. She attended the annual Marijuana Business Conference and Cannabis Expo (MJBizCon) late last year, and following the event, Greenhouse Grower Senior Editor Brian Sparks sat down with Gretchen for a virtual discussion of her top takeaways, and where the greenhouse cannabis market may be headed in 2023.

Gretchen Schimelpfenig: MJBizCon was sort of a different affair this year. It was great to connect with manufacturers to see what they’re coming up with and learn what they’ve been hearing about energy codes in 2023. It’s been a rough year for many in the industry, but one of the things I definitely noticed about the show was that the cannabis market continues to become more mature and professional. People are coming with more of a business mindset. There are also many who are new to having a business in this industry and are definitely trying to learn as much as they can. Design solutions are still kind of hard to navigate for growers, and many of the exhibiting companies are looking for ways to be the place where the grower can get everything.

Brian Sparks: With the challenging year this industry has had, are you seeing more reluctance for new companies to enter the market?

Gretchen Schimelpfenig: The costs of getting into the market and staying in operation are becoming prohibitive for some. As the adult use license market opens up, potential growers are having to invest a lot of money just in development. There are equity programs in cannabis licensing laws for pretty much every state, but for smaller growers, there’s still the financial hurdle just in terms of licensing fees. Once they do begin operating, some aren’t able to hit good margins because of equipment or materials costs. There’s also quickly a steep learning curve for costs of running a legitimate business, like compliance with requirements for tracking of the product. Inventory tracking is important for cannabis because it prevents people from selling across state lines. So even when people get into the market, if the number of farms in that market is high or if the regulations for that market change, the margins businesses need to achieve might not make it viable.

Brian Sparks: When you look at the information that is currently available to the market, are you seeing any gaps?

Gretchen Schimelpfenig: It’s definitely evolved over the past few years. At this year’s MJBizCon, I really liked that they separated the show floor into cultivation technology and postharvest dispensary supplies. A grower could simply go to the cultivation section, and then the person on their team who’s in charge of the dispensary could go to the other section of the floor.

One thing I saw much more of this year, and I think we will continue to see, is LED horticultural lighting technology one from end of the quality spectrum to the other. There was also a lot of HVAC and application equipment on display.

I do think there’s a gap in the ancillary services for controlling those pieces of equipment, especially when it comes to technology specific to greenhouse production. It’s still very much an indoor-focused conference. There were greenhouse companies there, but I would say there’s still a gap in that control space.

Brian Sparks: From the conversations you’ve had, where do you see production trending in terms of greenhouse versus indoor/warehouse versus outdoor?

Gretchen Schimelpfenig: I definitely think that the cannabis greenhouse market is on the upswing. One of the things that’s been interesting to see in the food side of the industry is that vertical farming companies are starting to have some constriction, so the businesses that weren’t going to be viable are starting to fall off. With indoor farming of cannabis, I don’t think there’s a completely identical trend, but we are, I think, going to see that greenhouse cannabis is going to be more economical in certain regions. It’s going to have a better environmental impact than indoor and maybe have different energy costs, and that’s going to change the proportion of the market. Let’s use Vermont as an example. A lot of people applied for outdoor licenses in Vermont, and there’s a portion of those people who are applying for mixed licenses who have both outdoor square footage and some controlled environment square footage, like hoop houses. The glass greenhouse market in Vermont has yet to emerge, but our climate doesn’t make sense for long harvests of only outdoor cannabis production. At the same time, indoor is going to have higher new construction costs, and the state doesn’t have a lot of square footage ready for indoor production. I think energy costs are going to lead to a larger greenhouse market. The problem is twofold. In a lot of places, electricity costs are getting higher. At the same time, some places have climates that require more heating, and heating fuel costs could prevent the greenhouse market from getting bigger in those regions.

I work with a lot of growers in Southern California, which is a very large greenhouse market. I think that greenhouse cannabis in certain regions of the country is going to dominate because that approach to cultivation protects the crop from climate change and doesn’t have some of the higher energy costs or higher operating costs of indoor environments.

Brian Sparks: It’s interesting to follow what’s happening with energy costs in Europe. Do you think we’ll see similar issues develop here in the U.S., regardless of crop?

Gretchen Schimelpfenig: As I mentioned in my last article, with the cost of electricity generated in North America being sourced from natural gas, and crude oil prices going up after Russia’s invasion of Ukraine, utilities are increasing rates in the U.S. for electricity and for natural gas. What’s interesting is that propane costs for heating haven’t gone up much compared to last year, and natural gas is only going up by around 10% in some areas, compared to electricity costs which might go up by 30%.

I think in 2023, we’re going to start to see the ripple effects of this happening in the U.S. because utilities are setting their rates and asking for rate increases based off of the costs they have to pay to make energy. Because of this, there could be a rise in the need for smart energy choices for companies with greenhouses in multiple states. On the MJBizCon show floor, I heard a lot of people talking about rebates, and suppliers were being more proactive in marketing them. Growers themselves may be more curious about that this year because of the energy cost conversation.