Floriculture’s Future Hangs in the Balance Between Labor and Technology

Growers are feeling the pressure from increased labor and input costs, dramatically reduced labor availability, more customer and market demands, and shrinking margins. This year, perhaps more than ever, the labor situation feels dire, and growers are taking action to relieve some of the pressure. From automating their operations to improving flow by changing production space layout to doing wage studies and investing more in pay and benefits for their valuable employees, Greenhouse Grower’s Top 100 Growers are readying their operations for the immediate and distant future.

We zeroed in on some of the key issues prevalent in this year’s survey, centered again on labor and technology, and what greenhouse growers are doing to address their labor issues. Articles in future issues of Greenhouse Grower and on GreenhouseGrower.com will provide additional detail on other topical areas affecting the Top 100 Growers.

Labor Woes Are Strangling Grower Operations

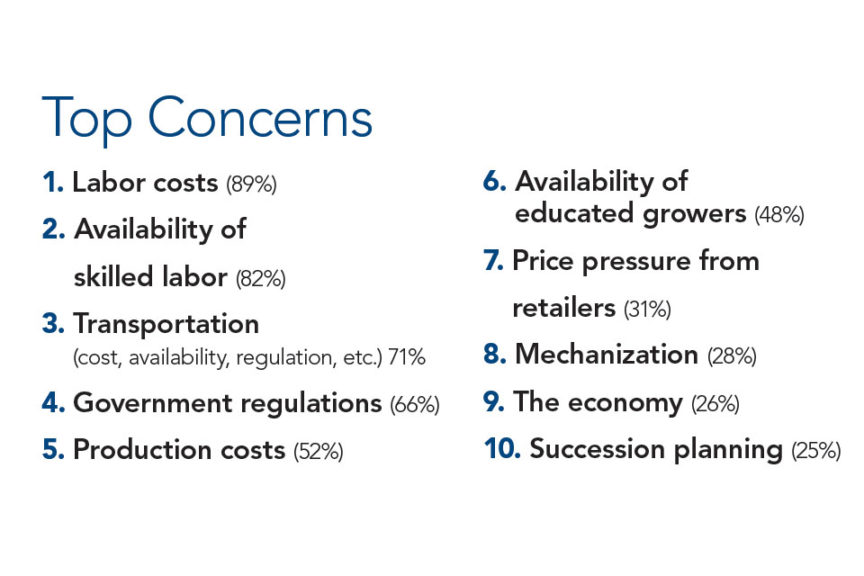

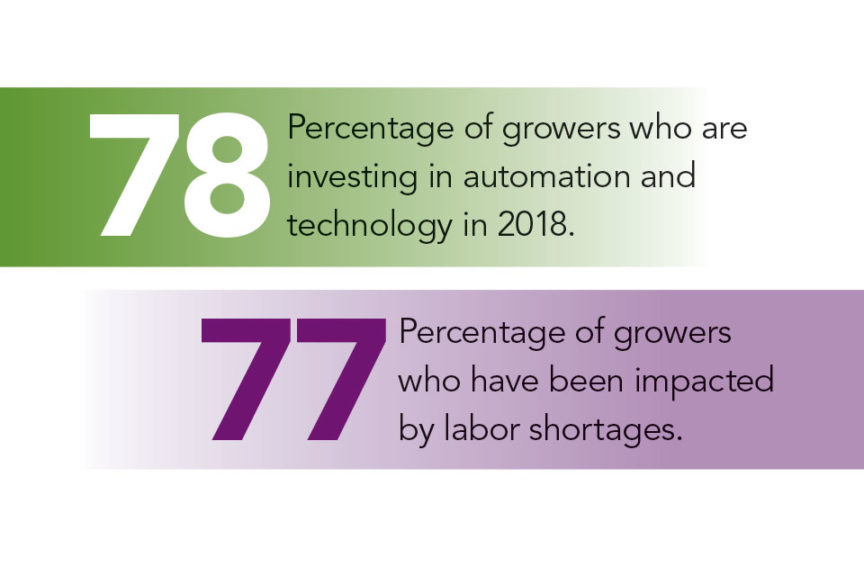

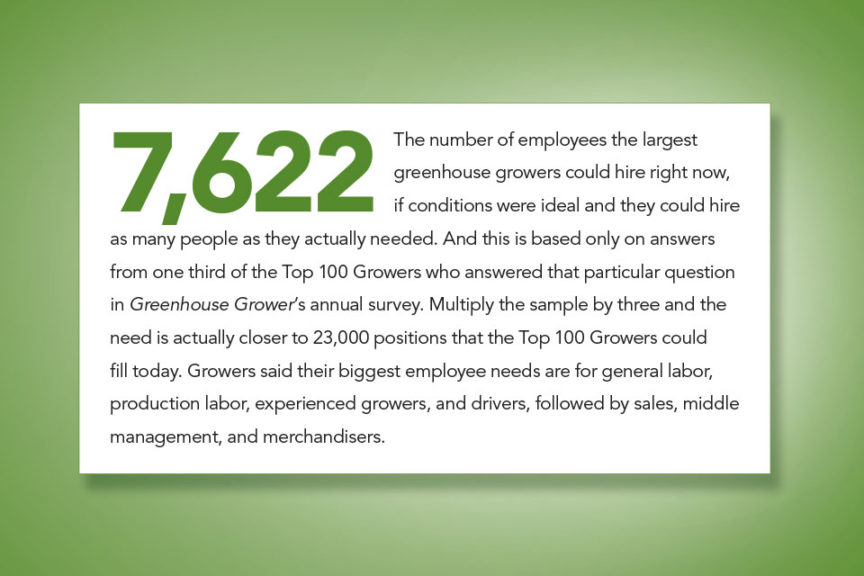

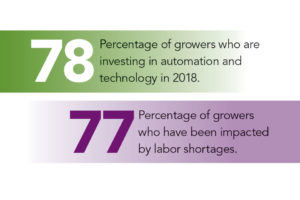

The labor problem just keeps getting worse, as 77% of the nation’s largest growers have been affected by labor shortages this past year. In Greenhouse Grower’s 2018 Top 100 Growers Survey, growers reported that labor costs and labor availability were far and away their biggest production challenges.

“Each year it becomes more difficult to obtain qualified labor and each year, the skill level of the existing labor pool drops, while their demand for higher wages increases,” said Kyle Peterson of Fessler Nursery.

More growers (35%) have lost employees to emerging markets within horticulture, like greenhouse food crops and cannabis production. The low unemployment rate and a booming economy and housing market are causing more hiring deficits, as well, causing growers to have to compete for labor not only within agricultural markets, but also among other sectors.

Shortages not only in production labor but also for drivers and merchandisers affect transportation needs and the ability to fulfill contracts at retail, growers said.

“Throwing more money at labor and transportation does not guarantee that demand can still be met. This can affect getting our product to market, as well as merchandising it once it get there,” said Ron Mercer of Masterpiece Flower Co./Henry Mast Greenhouses.

To remain competitive and make their greenhouse operations more attractive workplaces for employees, growers are providing better benefit packages for their workers, implementing profit-sharing programs, and paying more competitive wages and salaries to keep the valuable employees they have.

Growers Increasingly Frustrated With Government Regulations

With their businesses hanging in the balance between profitability and dire consequences because they can’t secure an adequate labor supply, growers aren’t waiting around to see what happens next. They demand rational immigration reform policy, but most of them are tentative about any potential solutions, especially one that might send good, hardworking employees away, and they can’t afford the time it takes for political posturing.

Only 20% of the Top 100 Growers currently use the H-2A guestworker program, according to the survey, which is up from 16% in 2017. Another 9% said they plan to start using a guestworker program in 2018 and 47% said they would be investigating guestworker options for the future.

But with the current crackdown on immigration by the Trump Administration, it may be tough for growers who haven’t used H-2A in the past to get into the program. The bureaucracy and time involved is one of the main deterrents for using it, growers said.

Cost is another main obstacle, due to the required hourly wages, mandatory provided housing, and meals that need to be provided to workers. Growers who use H-2A to fill out their labor needs said their labor costs increased overall.

“With the margins on our products, it’s smarter to cut back production to match the current labor force than to provide housing, meals, etc., for guestworkers,” said Richard Wilson of Colorama Nursery.

Many growers are not pleased with the current immigration reform situation in the U.S., and even those who are pro-Trump and pro-reform are discouraged by the way the Administration has handled immigration reform in the past year.

“Building a wall will only continue to damage our relationship with Mexico, cost everyone a lot of money, and won’t get us to the guestworker program that we need,” said Lisa Ambrosio of Wenke/Sunbelt Greenhouses. “I participated in the AmericanHort and SAF Congressional Action Days trying to make a difference. Without the people to do the job, labor costs will increase so prices will increase so consumer purchases will decrease.”

Mark Worley of Speedling said, “It’s very reckless and shortsighted. Prices will increase and certain jobs will not get done. Farmers are already leaving produce in the field because they can’t find labor to pick.”

Others say they don’t see immigration reform happening at all, since no presidential administration or congress to date has been successful in pushing through a comprehensive reform plan. However, most agree that decisionmakers need to listen to business owners, and create a realistic, bipartisan effort to provide guestworkers for agricultural crops.

“The main driver should be to enforce the rules we already have on the books,” said Abe VanWingerden of Metrolina Greenhouses. “At 4% unemployment, we have to be creative on how we attract labor in this country, but if we don’t follow or enforce the current rules, it is hard to come up with new ones that everyone agrees to. The administration wants to grow the economy in the end, so I believe cooler heads will prevail (Agriculture Secretary Sonny Perdue, Sen. Thom Tillis, etc.), and we will at least have a proposal that addresses all sides’ needs. But I am not sure it will pass due to our inability to compromise in the current political environment.”

Growers Are Driving Ahead by Implementing Efficiency Measures

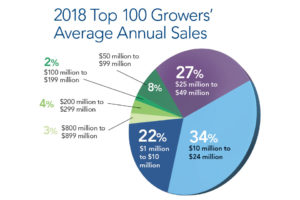

Reducing dependency on labor (76%) was an addition to the top three goals that have been prevalent for the past few years among large growers — increase efficiency (82%), increase profit margins (73%), and increase adoption of automation and technology (68%). To do this, 78% of the Top 100 Growers are hyperfocused on investing in automation equipment, the majority of which is production automation (59%), followed by computer software (47%), irrigation equipment and controls (41%), lighting (34%), and growing media handling equipment (34%).

“Labor costs are forcing us to change our business. We are looking at mechanization, but do not know if we will be able to pay for the investment,” said Robert Kitayama of Kitayama Brothers.

Structures and greenhouse coverings are another big area of growth for 42% of the top greenhouse growers, as 37% of them said they are expanding their businesses and building new structures, and 31% are retrofitting existing greenhouses and facilities.

Of those who said they’ll be expanding in the coming year, 64% said they will be building more greenhouses on their current sites, while 7% said they plan to acquire additional locations in the coming year.

Efficiency is the main driver behind growers’ investments in new and retrofitted structures, with changes to operation layout a top priority to implement Lean processes, minimize plant handling during production, and ultimately reduce the labor needs. Some growers are opting to pull down older, less-efficient greenhouses to improve the growing environment for better quality crops.

“We are utilizing a lean engineer to improve our flow and efficiencies,” said Randy Tagawa of Tagawa Greenhouses.

Chad Corso of Corso’s Perennials said, “We have relocated our shipping facility and implemented a new pulling-loading process based on Lean Flow manufacturing.”

Several growers are investing in software to help improve efficiency and layout, as well.

“Right now it is all about writing software to make the operation run smoother and more efficiently,” said Bill Swanekamp of Kube-Pak. “We just completed the first phase of our business-to-business software with a number of brokers to make plug and rooted cutting ordering much easier and more accurate.”

Could Growing High-Margin Crops Help Pay the Bills?

Growers are looking to diversify a bit more than in the past, with 9% saying they’ll pursue growing fresh greenhouse produce in the next three years, and 15% saying they may look that way. Others are looking more closely at cannabis, with 1.5% planning to pursue growing medical cannabis within three years, and 5% saying they’ll go after growing for both medical and recreational cannabis markets. Another 17% say they are still watching the cannabis market, federal laws, and legal status closely, and considering potential entry into the business in the coming years.

American greenhouse growers have only to look to their colleagues in the north to watch and see how the roll out of national cannabis legalization, slated for implementation this summer, affects the industry and the country. Several Canadian greenhouse growers of both ornamentals and greenhouse produce have converted their production space for cannabis production in anticipation of growing higher-margin crops, cultivating more demand and higher prices for the remaining flower growers. But it’s still too early to tell if that will be an ongoing boon to the Canadian horticultural economy or if the growers taking a risk on the new cannabis market will find it flooded and move back into traditional crops. Canada’s Ontario province, home to a typically booming horticultural market, has also recently implemented a 21% minimum wage hike, which has taken growers by storm, further eroding profit margins and making alternative markets and crops look that much more interesting.

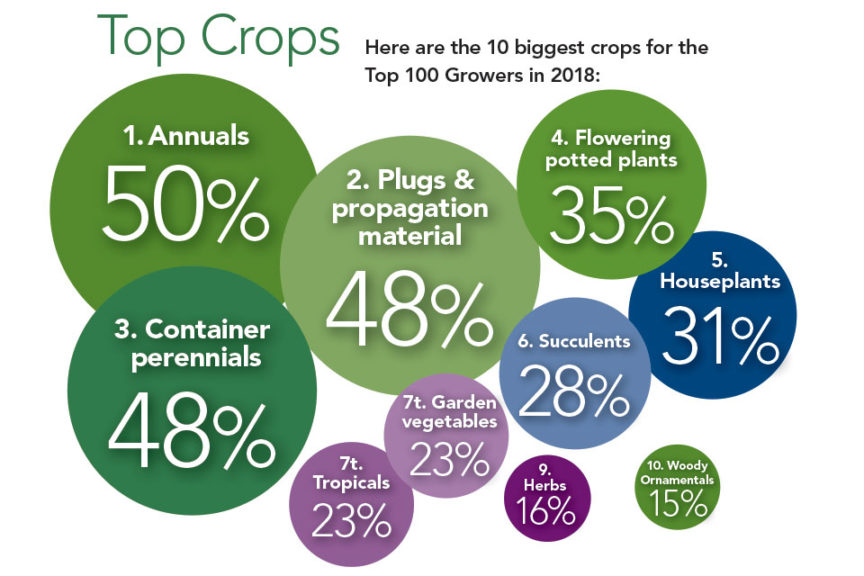

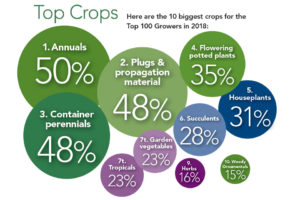

Among Top 100 Growers’ traditional crops, annuals, plugs and propagation, and container perennials continue to be the big three for large growers, but this year houseplants, succulents, and tropicals are getting more attention thanks to the growing demand for these crops among younger consumers. Garden vegetables and herbs are still strong, as well.

Sustainable Production Is a Growing Goal

Pest and disease challenges are issues that consume precious time for growers, and with broader adoption of integrated pest management (IPM) programs, combined with labor shortages and less availability of experienced growers, finding the right people to lead IPM implementation is a specific need.

This gets trickier with the threat of imported insect and disease pressures. While new industry-led initiatives focused on expedited imports are trying to mitigate these issues, growers say they are concerned about the continued problems they’ve seen year over year. As a result, they inspect upon arrival, detail the quality of plant material coming in, and verify and vet suppliers.

The majority of growers in the Top 100 say they are advanced (48%) or expert (20%) users of biological controls, while the rest are beginning to incorporate biocontrols in their integrated pest management (IPM) practices (18%) or not using them yet, and starting to look into it (14%). The most widely used tools are beneficial insects (82%) and biopesticides (68%) and other biochemicals (57%). Broader use of biostimulants is also starting to emerge within the market, with 37% of growers saying they use these plant health-focused products.

Organic production is on the rise among large growers, with 19% saying they currently grow organic crops and 9% saying they plan to be producing organic crops within the next three years. Sustainability is a broader focus, and a large number of the Top 100 Growers have been invested in sustainability certification programs, with more opting in rapidly. Because of the customer demand to grow more sustainably, growers are carefully selecting crop protection options and working with suppliers to trial new chemical and biological solutions.

“While not an impending issue yet, the risk we all face in instant social media and outside of the industry reaction to our chemistry programs is a concern,” VanWingerden said. “A chemical can be deemed safe by the EPA, but if we get negative social media reaction or direct-to-consumer messaging that says different, the instantaneous ‘don’t use that anymore’ reaction without scientific evidence is a risk to our ability to protect our crops.”

Broader adoption of automation and technology will also aid growers in better environmental and financial sustainability in the long term.

“I don’t know if automation will allow me to replace people,” said Mark Nash of Nash Greenhouses. “That sounds like the goal because it will save money. What I see it doing is it will allow the people to use their expertise or have more time to attend to the more important areas of the greenhouse (crop quality, etc.).”

Ambrosio said, “We have to be efficient if we want to be in business in the future.”