Here’s the Latest Updates on the Paycheck Protection Program

Regulations on federal financial relief programs in the wake of the coronavirus pandemic continue to evolve. AmericanHort and its partner organization K-Coe Isom have been at the forefront in keeping the horticulture industry up to date on important developments.

On June 26, AmericanHort hosted a webinar summarizing the most recent updates on how the Small Business Administration (SBA) is implementing rules and provisions in the Paycheck Protection Program (PPP), specifically those outlined in the PPP Flexibility Act, which was signed into law on June 5. This most recent webinar comes just a month after AmericanHort’s last update, and once again, K-Coe Isom’s Kala Jenkins and Beth Swanson shared their insights.

The complete webinar is available for on-demand viewing here, and it’s a must-watch for greenhouse owners and their human resources and accounting teams. Here are a few highlights:

- Craig Regelbrugge led off with a brief update on where the horticulture industry stands in regard to the Coronavirus Food Assistance Program (CFAP).

“The comment deadline ended on June 22, and we filed extensive comments working with 103 other organizations in the industry,” Regelbrugge said. “We also provided a fresh economic analysis with help from our economist, Charlie Hall. His latest numbers suggest losses due to COVID-19 in our industry will be between $732 million and $1.2 billion. We suggested how USDA should handle this for our industry, and we expect it will announce a final decision on our eligibility by the end of July.” - In early June, SBA and the Treasury Department issued a joint press release with updates on the PPP Flexibility Act and what business owners need to know. Among the new regulations are four categories that underwent significant updates: payroll tax deferrals, time frames for coverage periods, forgiveness changes, and forbearance changes.

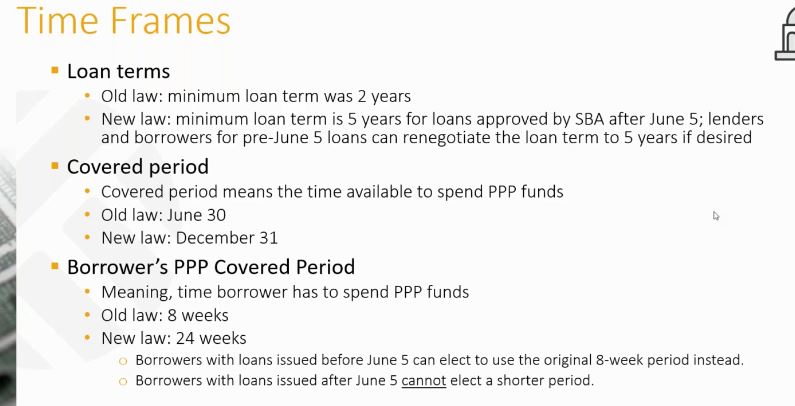

- Time frame changes are outlined in the image below. The most important thing, Jenkins says, is if you think the two-year loan term will be a challenge and you’re uncertain if your loan will be forgiven, talk to your lender.

- The percentages that cover how you can use loans to cover payroll costs versus mortgage/rent expenses and other non-payroll costs has been updated from 75%/25% to 60%/40%. However, Jenkins also noted that it is still unclear how transportation costs should be treated.

- One of the most important messages Jenkins and Swanson conveyed is that while SBA’s changes offer more flexibility in how borrowers can apply for loan forgiveness through the Paycheck Protection Program, it’s critical to verify everything with your lender, and to document as much as you can.