Despite Current Challenges, CEA Offers a Positive Long-Term Future

Controlled-environment agriculture (CEA) has been receiving a lot of attention, and investment to the tune of $7 billion over the past few years, but recent events may make growers and investors wonder if the industry will ever live up to the hype.

While leading a panel discussion CEA and the future of food at the recent Vision Conference, Henry Gordon Smith, Founder and CEO of Agritecture, said he thinks today’s CEA troubles are a hiccup on forward progress. Recent operations have shuttered primarily because of dramatically increased fuel costs, although typical problems like poor planning also hamstring success. Still, he is undeterred.

“We really are on a mission to accelerate climate smart agriculture. It will allow us to grow the food in certain places where we weren’t able to before; to use less water, use less land,” he said, “And to do that globally.”

There are two types of CEA, he explained,

“One of them is vertical farming, which is typically the stack cultivation of crops,” Gordon Smith said. “And a hydro system tends to have no natural lights, completely artificial, or there’s greenhouses that have natural lights, sometimes artificial light.”

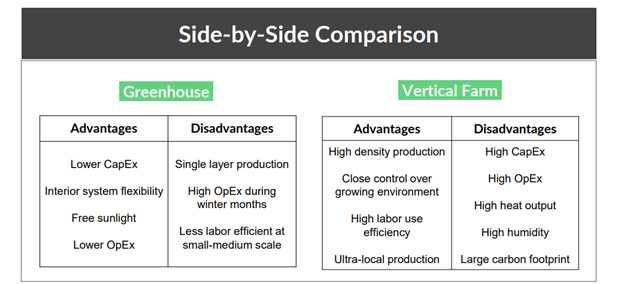

Selecting the right type of controlled-environment agriculture system is a very important decision that determines the long-term success of any project. The chart below highlights some of the differences.

Local Bounti is a company with greenhouses in six locations in the U.S. and is interested in not only lowering water, land, and chemical usage, but delivering a fresher, higher-quality product that consumers will pay more for, and to create innovative products that encourage consumers to eat more fresh produce.

By having locations where the furthest food has to travel is only 400 miles, compared to the typical 1,200 miles, Local Bounti can provide fresh greens with a shelf life three to five times the average field grown green. That benefits retailers and consumers and lowers food waste. The company’s emphasis is on sustainability and the consumer, notes David Vosburg, Chief Innovation Officer of Local Bounti and one of the panelists in the discussion.

“All these technologies are not panaceas, they’re tools that we used effectively in different geographies at different times for different crops to generate profit. So that’s, the first point. The second is unit economics. This is the driver of everything that we do,” he said. “The third point I’ll make is that with CEA, specialty crops have an opportunity to be different. It’s cleaner, it has a longer shelf life and has a potential to go into value-added products in a new way that can delight the customer.”

A publicly traded company, Local Bounti halved its losses from 2021 to 2022, and analysts predict the company will break even in 2024, assuming an aggressive growth model of 59% year over year, which is not impossible for a company in growth mode.

Dave Chen, Founder and CEO of Equilibrium Capital, said his company got into CEA in about 2015 because it saw that Walmart, one of the U.S,’s largest food retailers, had concerns about its fresh produce supply.

“They were increasingly concerned about the resilience of their fresh produce supply chain because of the volatility that they were starting to see, because so much produce comes from California and they were having a drought and water use issues,” Chen said. “We drove around Holland and asked why Europeans have 45,000 acres of greenhouse production, and the U.S. has less than 1,000 acres. We have no doubt that controlled-environment agriculture will happen in the U.S., and we want to be able to fund and guide good businesses in the industry.”

One of the farms Chen’s firm has funded is Little Leaf Farms, responsible for 42% of indoor-grown leafy greens sold in the U.S. A recent round of funding brought in $300 million of new capital to expand facilities across the US.

Fellow panelist and Founder and CEO of Little Leaf Farms Paul Sellew calls himself a farm boy, and says being profitable was drilled into his head since he drove his first tractor.

“I don’t view this as a tech play,” he said. “This is about producing food and supplying it to a very competitive retail grocery customer that is very focused on what they’re buying for. We have been profitable since our second year in business. We initially financed it the old-fashioned way, I signed on the bank note and put up equity capital.”

Sellew pointed out that in retail fresh tomatoes, 60% is now produced in greenhouses, and he believes the same trend will occur in salad greens.

“Right now, we are 3% of the total market,” he noted. “And if you visit greens facilities, they are all different. If you visit tomato greenhouses, they are all the same. They’ve found the right answers to the production problem. I think we will get there with leafy greens as well.”

The market shows a shake-out happening among producers, because of rising costs and poor business models, but these experts believe that once the industry is over the trough of disillusionment that is happening right now, the future for controlled-environment agriculture is bright.

“Prior to 2022, you could say money was free. Right now we are in a rising interest rate inflationary environment. The money losing business models that are out there do not have investors willing to continue to support them, we already seeing bankruptcies and layoffs. And I think we’re in early state right now. But having said that, winning business models will emerge as well,” Chen said. “We’re always looking for the operators that understand what the job is — to apply technology to make a competitive difference in either value, productivity, taste for the consumer.”

Vosburg echoes this sentiment.

“I think there’s opportunity to really engage with customer and create more delight,” he said. “Our goal is to create something that will taste better, will last long term in the fridge, and hopefully delight the customer better. I think there’s always going to be a market for that.”